Truck Parking Club Partners with Shell Rotella to Offer Drivers Up to $100 in Truck Parking

FOR IMMEDIATE RELEASE "Night on Us" promotion rewards drivers with up to $100 in Truck Parking Club Cash

Plus, a TQL recruiting video gets a lot of reactions, the greatest trucking advertisement of all time, and a freight meme.

TGIF. Wouldn't it be nice if call-ins for loads were handled by AI? Fleetworks, a YC-backed company, just debuted their AI broker that handles load inquiries. Scroll below to watch the phone call between a carrier calling in and the AI robot. Besides that, we did a deep dive on the rising road risks and insurance costs for trucking companies.

If you enjoyed this newsletter, help support us by forwarding it to a coworker or colleague.

🤔 Question of the Day: Since 2009, the Truck Safety Coalition (TSC) points out that there has been a __% increase in truck crash fatalities. Read our main story to find out.

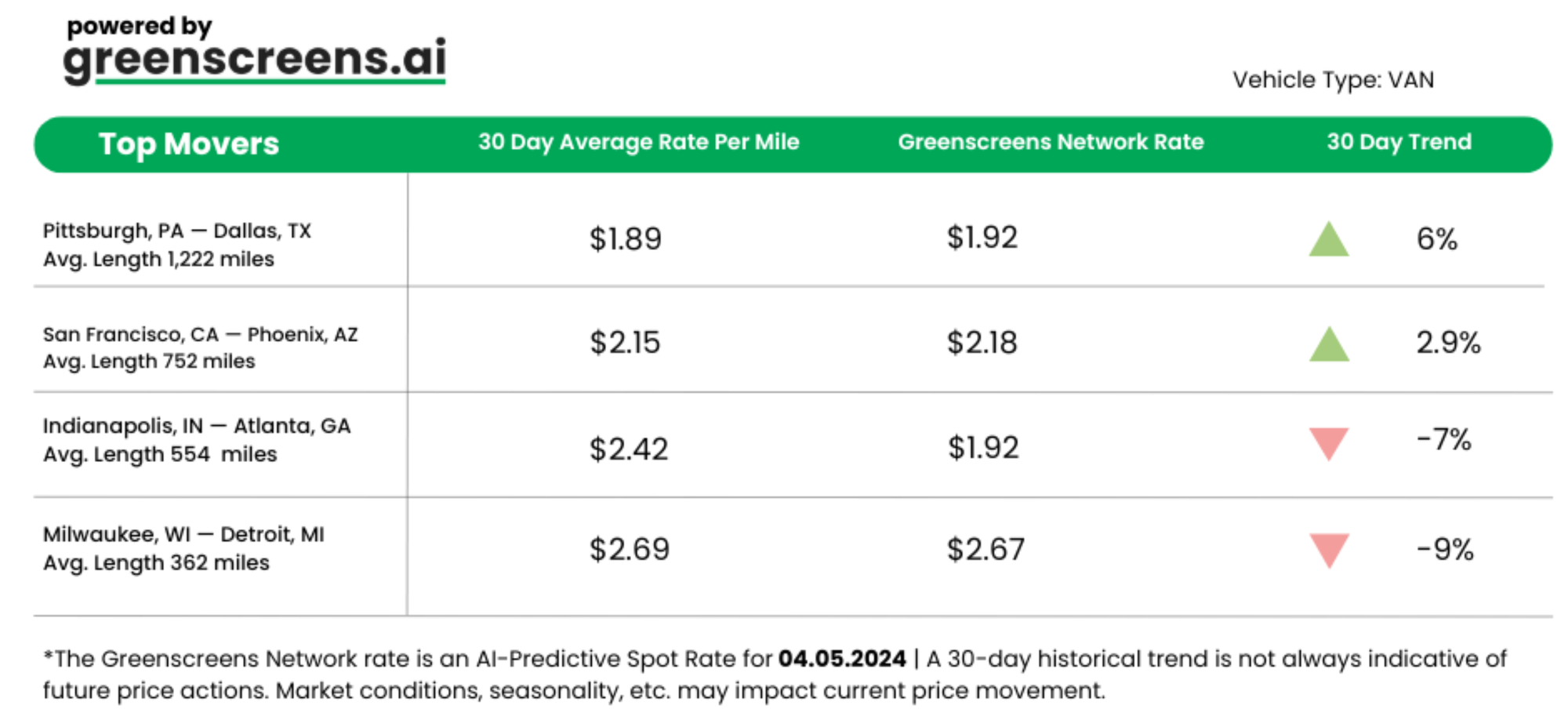

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

*Greenscreens.ai, forecasts real-time truckload buy prices that are suited to each freight brokerage's purchasing power using AI and machine learning. Its engine takes into account over 130 attributes and data points in each rate forecast.

🐔 WHAT’S COOKIN’ IN FREIGHT

🤖 Fleetworks AI Broker Handles Load Inquiry Call. Y Combinator-backed FleetWorks showcases its AI that talks the talk, making billions of industry calls and emails a thing of the past. Founded by Paul Singer of Uber Freight and Quang Tran, an Airbnb innovator and AI NFT co-founder, this startup is on a mission to cut costs and boost efficiency. With its use of voice synthesis and generative AI, FleetWorks tackles everything from scheduling to delay management, aiming to sideline the industry's biggest expense: human labor. This demo call demonstrates the AI's cool head, fixing date mix-ups with ease and keeping cargo on the move.

🚢 Volumes at Top US Ports Return to Pre-Pandemic Levels. US ports, where 40% of international freight value docks, are key economic trend indicators. Pre-pandemic, these hubs handled a steady 46 million TEUs. At the pandemic's peak, they grappled with over 53 million TEUs. 2023 data shows that things leveled out slightly higher than the old normal, at 46.67 million TEUs. Still, recent events like the Baltimore port closure, the Panama Canal drought, and the Red Sea ship attacks remind us that stability in maritime logistics is often at the mercy of unpredictable global events.

🍺 Beer Bandits Arrested. Eight men dubbed the "Beer Theft Enterprise" are charged with stealing vast volumes of beer from Northeast rail yards and warehouses. From July 2022 to March 2024, this crew allegedly stole primarily Corona and Modelo brews, pouring "hundreds of thousands" in losses onto companies. Led by Jose Cesari, 27, they sliced through security to stash U-Hauls with stolen cases of beer, later sold in the Bronx. Cesari lured looters via Instagram, promising up to $100K monthly. Charged with conspiracy and more, the men are awaiting trial.

TOGETHER WITH ARMSTRONG TRANSPORT GROUP

Are you an experienced freight agent looking to grow your business? Partner with Armstrong Transport Group to take your business to new heights. Join a team where your experience is valued, and we're committed to enhancing your success. Click here to explore your next big opportunity!

The trucking industry seems to be getting battered from every side lately. Outside of the prolonged freight recession, there are higher accident rates, eye-watering legal payouts, and steadily rising insurance premiums.

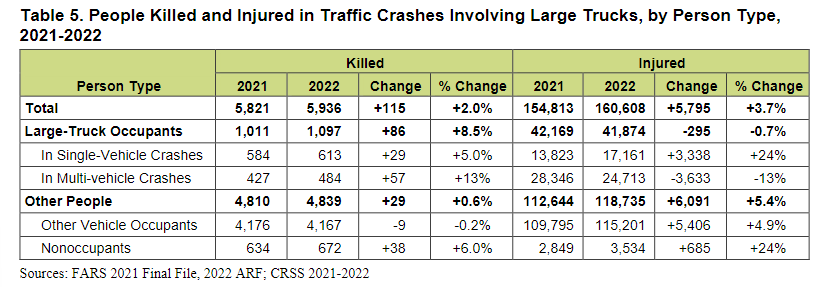

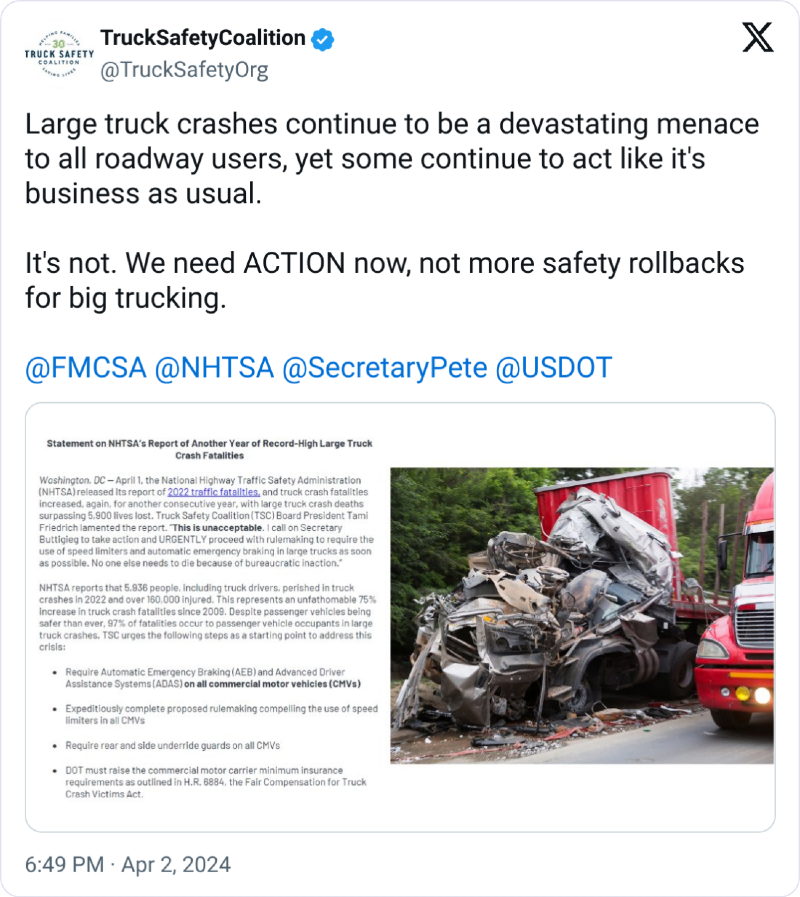

The National Highway Traffic Safety Administration (NHTSA) reports a 2% increase in fatalities involving heavy trucks, with 5,936 deaths in 2022.

While this represents a slower increase, the Truck Safety Coalition (TSC) points out that there has been a 75% increase in truck crash fatalities since 2009. The TSC calls for legislation on speed limiters and automatic braking in trucks to address the issue.

A Missouri court recently upheld a $20 million verdict against Great Plains Trucking, continuing the trend of large payouts for trucking accidents. It's also a clear sign of the judiciary's stance on corporate accountability in road safety.

Meanwhile, in Wisconsin, Governor Tony Evers vetoed Senate Bill 613, a significant legal reform for motor carriers. SB613 aims to cap noneconomic (think pain and suffering, mental anguish, etc.) damages at $1 million to push back on the trend of rising nuclear verdicts.

This move was debated heavily, with supporters arguing it would address the almost 1,000% increase in average verdict size for lawsuits above $1 million involving truck crashes.

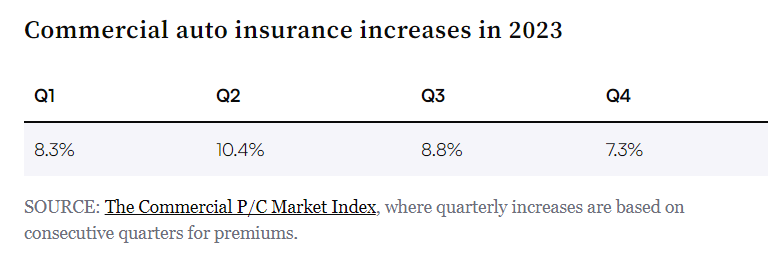

Insurance premiums for trucking companies have seen sharp increases, with some regions experiencing upticks as high as 29% in the last quarter of 2023.

However, the average hike in commercial auto premiums slowed down from an 8.8% leap in Q3 to a gentler 7.3% increase in Q4 – which signals stabilization.

Industry insiders have been vocal about the pressures these hikes exert on their operations. Joe Boelman, an owner-operator and chairman of the Trucking Solutions Group, likened absorbing these costs to biting a bullet—a necessary but painful part of doing business.

Major player, Knight-Swift, even announced the shutdown of its third-party insurance business in early 2024 as a direct response to the challenges posed by the insurance market, including frequent and severe claims.

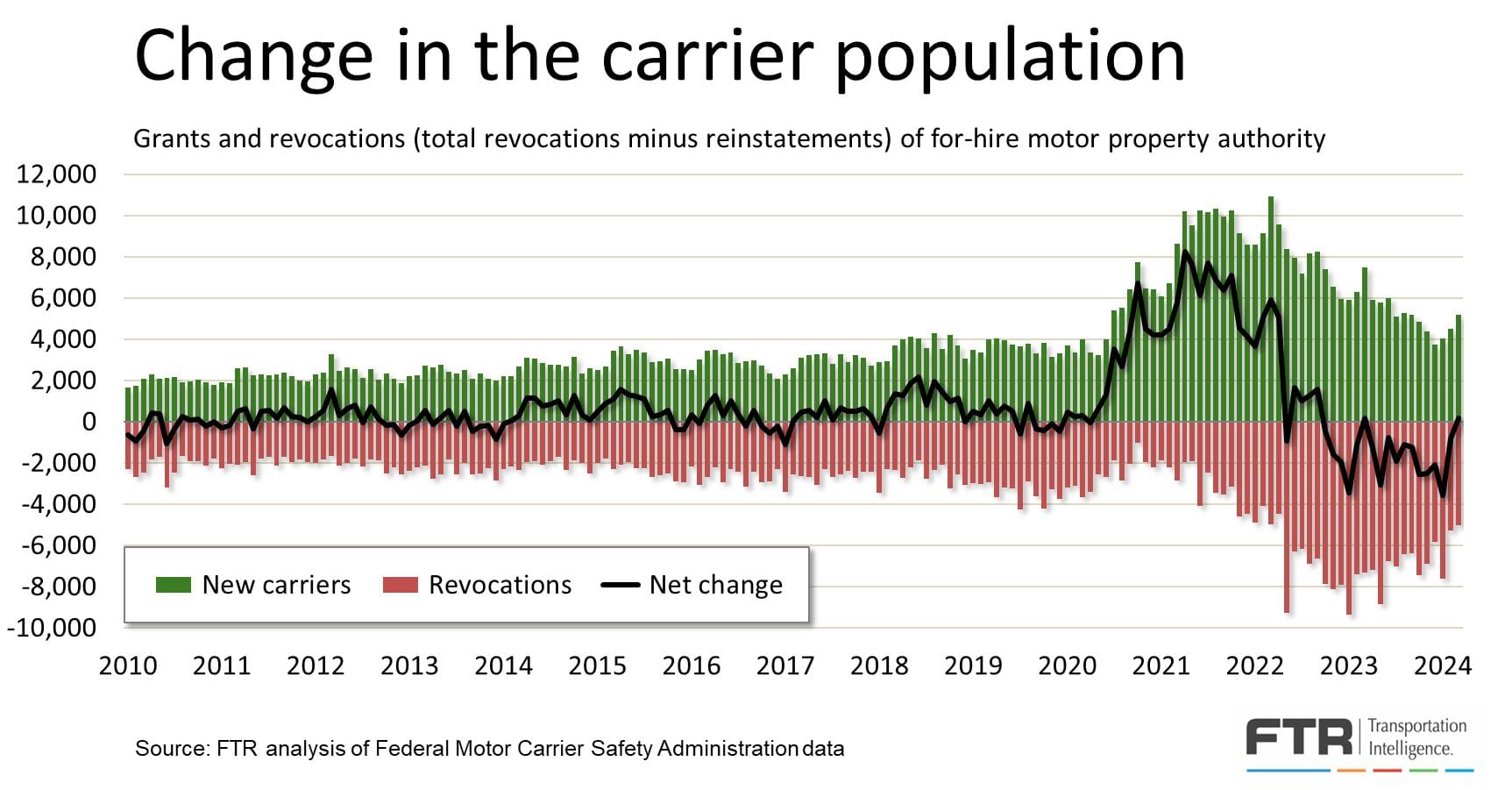

The interplay of these factors is pushing on carrier exits, which are necessary for the freight market to pull out of its slump. If that's the case, it's interesting that the number of newly authorized MCs has seen an uptick. Does this mean we're on the up and up? Not so fast.

"The movements probably reflect natural volatility and seasonality in the data. Certainly, the tiny March 2023 net increase did not signal an inflection. Rather, recent entry and exit changes might indicate a response to temporary developments that occurred three months or so ago." – Avery Vise, VP of Trucking at FTR Transportation Intelligence

To sum up, the upswing could have been a bold poker bluff against tough odds. Hopeful newcomers were sensing an opportunity, while veterans saw challenges.

Sources: Trucking Dive | NHTSA |FreightWaves | LandLine

THE WORLD'S MOST POPULAR TMS

AscendTMS is the world's most popular & best-rated TMS. Use our referral code RA-FreightCaviar! to receive 3 months of AscendTMS Premium for free. It only takes 20 seconds to sign up and no credit card is required. Click here to learn more.

AROUND THE FREIGHT WEB

🎮 TQL Plays A Lot of Games. TQL, which recently won plenty of awards around the US for "Best Company to Work For," released a video on LinkedIn that we reshared. The comment section on Instagram, LinkedIn & X was quite ruthless.

🚛 The Greatest Trucking Ad of All Time. The creativity and comedic angle this advertisement for a trucking & trailer repair shop in Chicago took deserves some awards.

🐟 100k Salmon Slip Out of a Truck. An Oregon Department of Fish and Wildlife tanker crashed, releasing 102,000 salmon smolts into Lookingglass Creek, a potential boon for local ecosystems.

🚂 CSX's New Route. In response to the Port of Baltimore's closure, CSX successfully completes its first shipments via a new rail line.

🛑 Trucking Company Shutdown. Frank Jauregui Trucking, a California based trucking company of 19 years, closes its doors.

🔋 Nikola's Delivery Milestone. Nikola surpasses first-quarter delivery estimates, producing 43 hydrogen trucks.

🎣 FREIGHT CAVIAR CORNER

Michael Caney, the Chief Commercial Officer at Highway, joined us on the latest FreightCaviar Podcast to discuss how Highway is tackling the $700M fraud problem that is plaguing our industry.

Learn more about freight fraud & how Highway is stopping it by listening on Apple Podcasts, Spotify, or YouTube.

This weeks podcast is sponsored by Levity.ai. *Please support our sponsors. 😉

FREIGHT MEME OF THE DAY

Also, check out:

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).