🎣 Freight Stocks Got Rocked

A penny stock wiped $4.8B off C.H. Robinson's market cap yesterday. Plus: self-driving trucks are now running 1,000 miles nonstop, STG Logistics cleared a major bankruptcy hurdle, the FMCSA revoked nine ELDs, and more.

A penny stock wiped $4.8B off C.H. Robinson's market cap yesterday. Plus: self-driving trucks are now running 1,000 miles nonstop, STG Logistics cleared a major bankruptcy hurdle, the FMCSA revoked nine ELDs, and more.

TGIF. A penny stock wiped $4.8B off C.H. Robinson’s market cap yesterday. We break down what happened in today’s feature.

Plus:

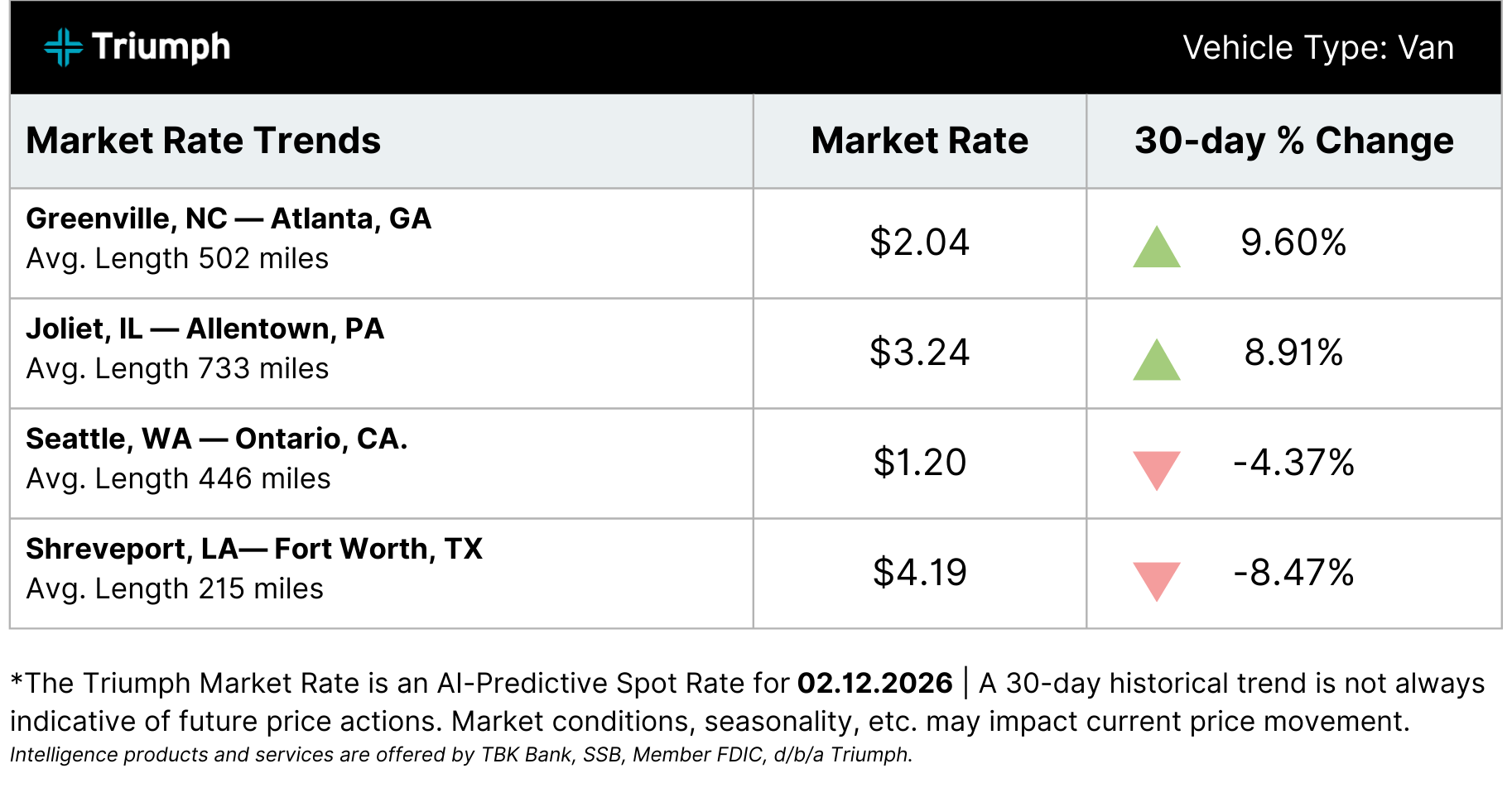

Market Lane Data Presented by Triumph

🍳 What's Cookin' In Freight

🚛 Aurora Just Broke HOS. Aurora says a new software update lets its driverless trucks run a ~1,000-mile Phoenix↔Fort Worth lane nonstop (about 15 hours) because robots aren’t bound by Hours-of-Service rest rules like human drivers. The company is expanding its Sun Belt network and claims autonomy “around the clock” is a margin unlock for shippers and carriers. Aurora currently has five fully driverless trucks hauling freight between Dallas, Houston, Fort Worth, and El Paso, and expects to have 200+ driverless trucks by year-end, supported by faster automated mapping and lower-cost next-gen hardware expected in Q2 2026. Watch their self-driving truck in action here.

🚨 STG Logistics Gets a Lifeline. An update out of the Journal of Commerce shows STG Logistics clearing a major bankruptcy hurdle this week. The ruling unlocks $40M in new cash plus $25M in reserves and, critically, blocks creditors (including Class I railroads) from changing credit terms mid-case. In plain English: no sudden “pay us upfront” demands just because STG is in Chapter 11. Creditors must honor pre-bankruptcy terms. The decision stabilizes day-to-day operations and keeps containers moving (at least for now) following weeks of uncertainty around STG’s liquidity and vendor relationships.

📟 ELD Fraud Is a Business Model. A trending LinkedIn post claims compliant fleets face a ~$ 3,000-per-truck-per-month disadvantage compared to carriers tampering with ELDs. By extending driver hours beyond legal limits, charging lower rates, and paying approximately $30 per week for log editing, non-compliant carriers gain a structural cost advantage. Commenters argue it goes beyond ELDs, pointing to insurance gaming, tow-away loopholes, and tax evasion. The post coincided with the FMCSA announcing it revoked nine ELDs, giving carriers 60 days (until April 14, 2026) to replace them or risk going OOS.

Presented by Levity.ai

Levity automates high-volume email and phone tasks like quoting, load building, and track & trace, without black-box agents or risky AI experiments.

Designed for teams that need control, transparency, and results they can trust.

Yesterday was supposed to be another normal trading day for transportation stocks.

Instead, it turned into one of the strangest AI-driven selloffs the freight market has ever seen.

A tiny Florida penny stock (formerly a karaoke machine company) published a press release claiming its AI could move 300–400% more freight without adding staff.

Within hours, billions of dollars in freight market value were gone.

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).