🎣 FreightWaves vs. DAT

Plus, Indiana-based trucking company with over 100 trucks files for bankruptcy, Transfix sells its brokerage arm, and more.

Happy Hump Day. Atlanta was the place to be yesterday and today as FreightWaves hosted its third annual Future of Supply Chain event. In today's deep dive, we'll take a look at what went down yesterday and tell you who won The Great Debate between FreightWaves Sonar and DAT.

🤔 Question of the Day: Transfix, a digital freight brokerage that had raised over $200 million, has sold its freight brokerage arm to __________. Find out in our What's Cookin' in Freight section.

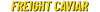

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

*Greenscreens.ai, forecasts real-time truckload buy prices that are suited to each freight brokerage's purchasing power using AI and machine learning. Its engine takes into account over 130 attributes and data points in each rate forecast.

🐔 WHAT’S COOKIN’ IN FREIGHT

🚚 APL Cargo Files Bankruptcy; Adds to List of Closures. APL Cargo, an Indiana-based trucking company with 122 drivers, has filed for Chapter 11 bankruptcy amidst financial woes and a lawsuit alleging driver misclassification. This filing adds to a series of high-profile trucking company closures over the past five years, including Yellow Corporation and Celadon Group. Economic pressures, regulatory challenges, and market fluctuations have made survival difficult for many in the industry. As the freight market faces uncertainty, the future for many trucking companies remains precarious.

🤖 Digital Freight Startup Transfix Sells Brokerage Unit to NFI. Transfix, a digital freight startup, has sold its brokerage unit to NFI Industries, resetting its focus on software amid a challenging market. The sale includes the transfer of over 100 employees and aims to leverage Transfix's software as a primary asset, providing automated transaction capabilities for high-volume, low-margin products. This strategic shift comes after a postponed public listing and continued financial pressures in the freight industry.

🏭 Mixed Manufacturing Signals. The U.S. manufacturing sector is feeling the heat, with the ISM Manufacturing PMI dipping to 48.7 in May 2024, signaling ongoing contraction. New orders dropped by 3.7 points to 45.4, and production slowed down. High borrowing costs and restrained investments are major culprits. On the flip side, manufacturing construction spending hit a record high in April, driven by sectors like electronics and electrical, thanks to the CHIPS Act and Inflation Reduction Act. Meanwhile, Chicago's Manufacturing PMI plummeted to 35.4, its lowest since May 2020. Why the mixed signals? High construction spending driven by government incentives contrasts with overall weakened manufacturing activity.

From full truckload and LTL to intermodal, reefer, flatbed, and oversized cargo, we understand the value of your unique network and goals – so we can work together over and over again.

Learn more about the DLX difference.

Day One Done: FreightWaves Future of Supply Chain 2024

Here’s a rundown on what’s up at the FreightWaves "Future of Supply Chain" event happening right now in Atlanta.

The event kicked off on June 4 and runs through today, June 5, 2024, at the Georgia International Convention Center. It’s the third annual conference, and it’s pulling together industry leaders, futurists, and supply chain leaders to dive into the latest in FreightTech.

70+ Speakers including:

- Bill Seward (UPS): Sharing insights on supply chain solutions.

- Brad Hicks (J.B. Hunt): Discussing highway services and company culture.

- Ryan Petersen (Flexport): Bringing visionary thoughts to the stage.

40+ Demos:

- Turvo: Showcased their innovative supply chain management platform.

- MyCarrier: Introduced new logistics optimization tools.

- Truckstop: Displayed their latest data analytics solutions.

For those not in the loop, this event is where you get to see the future of supply chain technology unfold. Attendees are hyped about the innovation and insights on display. Social media shows a lot of excitement around VIP networking opportunities, the live demos, and the much-anticipated debate between DAT's Ken Adamo and SONAR's Zach Strickland.

FreightWaves Sonar vs. DAT Debate

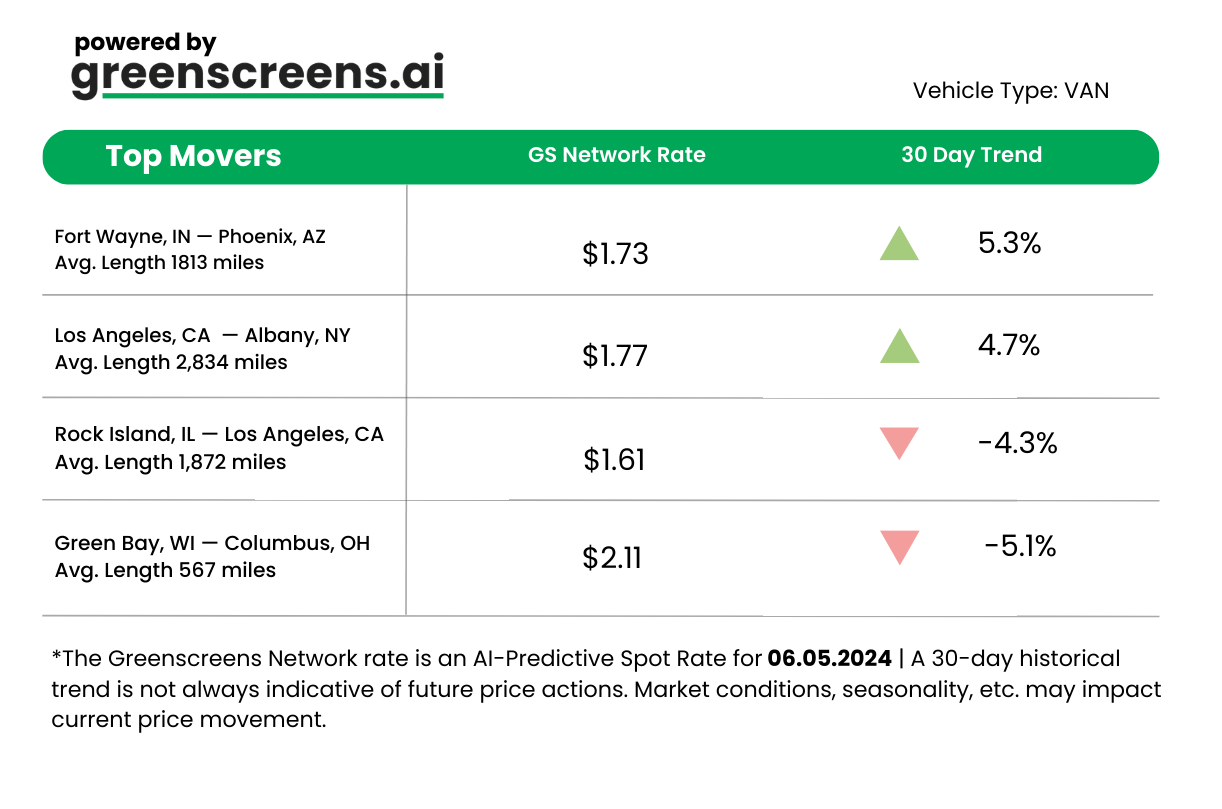

A challenge was struck via social media and it was insights vs. insights: FreightWaves SONAR versus DAT Freight & Analytics. The two giants debated what the second half of 2024 holds for domestic transportation. From the look of social media, it looks like Ken Adamo, the Chief of Analytics at DAT, won the debate.

FreightWaves donated $10,000 to the St. Christopher Truckers Relief Fund, a non-profit organization that assists semi-truck drivers who have experienced illness or injury.

Three Other Takeaways from Day One

- Heartland Express Struggles Highlighted:

- Craig Fuller discussed the troubling state of Heartland Express. Their adjusted operating ratio has worsened significantly over the past nine quarters, peaking at 105.6% in 1Q2024, a trend not seen in any other trucking company.

- Positive Signs in the Market:

- In the chat with Bill Seward, President of Supply Chain Solutions at UPS, says they are "seeing signs of green shoots."

- U.S. - Mexico trade:

- Cargado's Matt Silver pointed out how U.S. - Mexico trade was a part of every discussion on the stage.

Live Stream

Day two is underway. You can catch everything right from your desk chair on the event's live stream.

TOGETHER WITH TEXTLOCATE

TextLocate makes it easy for brokers to communicate directly with drivers via SMS-based text messaging—no app to download—without having to use personal communication devices. Features like 2-way text chat, one-time location updates, and image capture (think BOLs and PODs) all inside a simple dashboard give brokers the quick updates they need to make better decisions about freight. Instead of wasting time calling drivers, brokers simply automate the process through TextLocate and save hours at very little cost investment.

Click here to schedule a demo with TextLocate.

🌎 AROUND THE FREIGHT WEB

🚚 Lower Wacker Drive Trouble. A truck and trailer got stuck in Lower Wacker Drive in Chicago.

🔒 Cybersecurity Alert. Scammers continue to imitate MyCarrierPacket with phishing emails; always verify URLs to avoid falling for scams.

📈 Logistics IPO Outlook. After a dry spell, logistics firms like Lineage Logistics are gearing up for IPOs, which means a possible revival in capital markets.

🤖 Flexport Expands Convoy Platform. Flexport expands its AI-powered Convoy Platform to connect brokers with carriers, promising up to 90% cost reduction, but faces skepticism from the freight community.

📊 Saia’s Stock Surge. Saia's stock jumps 14% due to a spike in shipments, suggesting strong upcoming quarterly results.

⚖️ Yellow’s Legal Victory. Yellow Corp. secures more time for its bankruptcy liquidation plan, amidst debate over high fees and expenses.

🎣 THE FREIGHT CAVIAR PODCAST

In this week's The FreightCaviar Podcast, we interviewed Bill Loupée, a produce shipper. Bill shared insights from his career, the effectiveness of freight broker pitches, and challenges in produce logistics. He discussed market trends predicting a 20% uptick in freight rates, the volatility of fragile commodities, and the importance of effective communication.

Listen to the entire interview on Apple Podcasts, Spotify, or YouTube.

FREIGHT MEME OF THE DAY

Also, check out:

- 🎧 The FreightCaviar Podcast. Listen to this week's podcast on Spotify & Apple Podcasts.

- Want to get your brand noticed by freight brokers? FreightCaviar can help. Work with us to get your services featured in our newsletter, podcast, and more. Plus, we write great articles about what you do. Get in touch with Paul at pbj@freightcaviar.com to learn more.