🎣 From Speed Limiters to Stolen Loads: The Week in Freight

Happy 4th of July Week: Here's a round-up of the most engaging and talked-about freight content from around the web and from us.

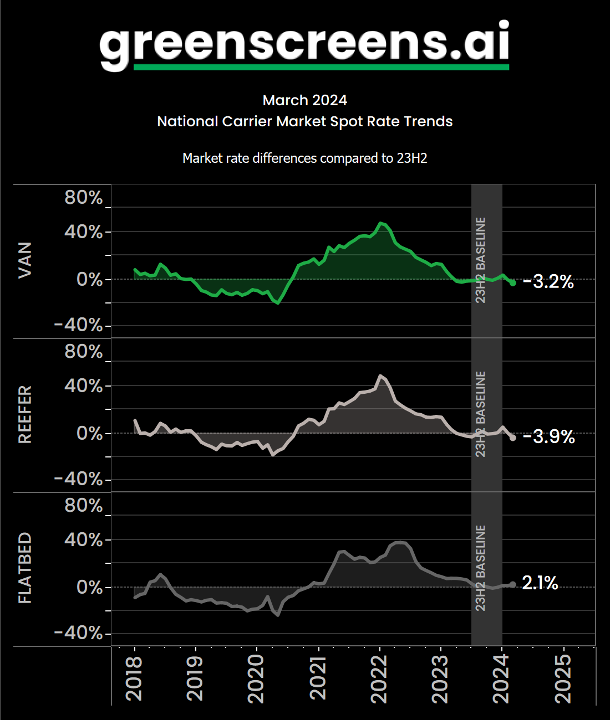

As we move into Q2, Greenscreens.ai shares its March 2024 Spot Market Update, tracking rates from across the nation.

Greenscreens.ai published its March 2024 Spot Market Update, revealing how spot rates are moving across the map.

Van and Reefer rates were down a bit, showing a -3.2% and -3.9% shift from last year's end. Meanwhile, Flatbed saw an increase at +2.1%.

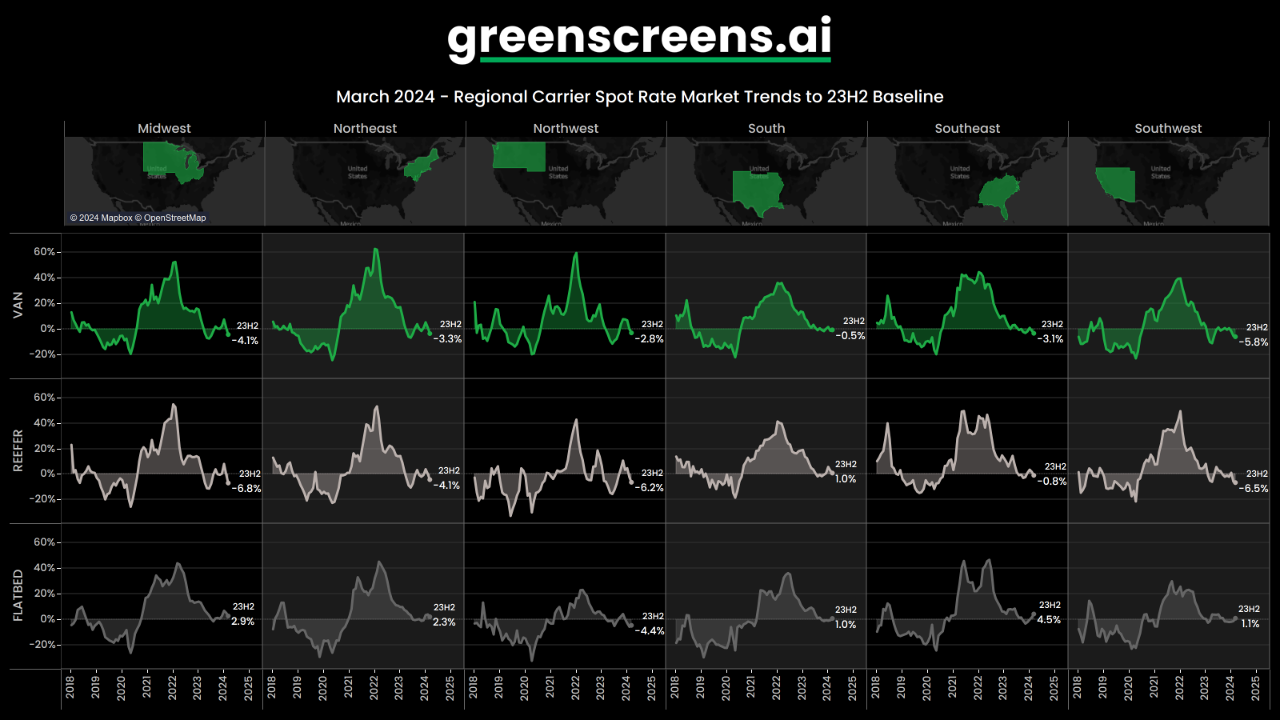

The Midwest grapples with the steepest Reefer rate decrease at -6.8%, while the Southeast shows a mixed bag: a slight dip in Reefer rates at -0.8% but a notable rise in Flatbed rates at +4.5%.

| Region | Van (23H2) | Reefer (23H2) | Flatbed (23H2) |

|---|---|---|---|

| Midwest | -4.1% | -6.8% | +2.9% |

| Northeast | -3.3% | -4.1% | +2.3% |

| Northwest | -2.8% | -6.2% | -4.4% |

| South | -0.5% | +1.0% | -0.8% |

| Southeast | -3.1% | -0.8% | +4.5% |

| Southwest | -5.8% | -6.5% | +1.1% |

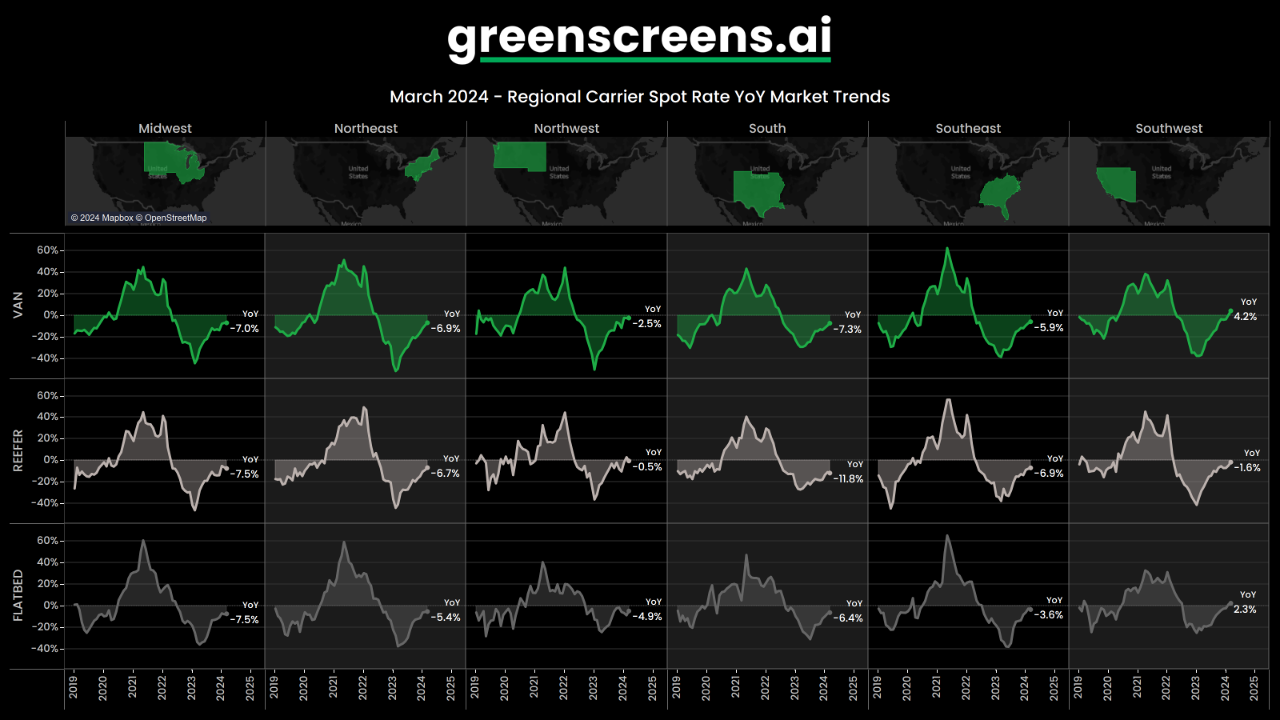

March '24 spot rate trends hit Reefers in the South hardest at -11.8%, while the Midwest felt the pinch across all types, with Vans and Reefers down by 7%. Here's a closer look at the numbers:

| Region | Van (YoY) | Reefer (YoY) | Flatbed (YoY) |

|---|---|---|---|

| Midwest | -7.0% | -7.5% | -7.5% |

| Northeast | -6.9% | -6.7% | -5.4% |

| Northwest | -2.5% | -0.5% | -4.9% |

| South | -7.3% | -11.8% | -6.4% |

| Southeast | -5.9% | -6.9% | -3.6% |

| Southwest | -4.2% | -1.6% | +2.3% |

Outlook? As Q1 rounds the bend, the second quarter's horizon could signal a milder climate for van and reefer rates or a long haul through the rest of '24 if downward trends persist.

Source: Greenscreens.ai

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).