🎣 Warrants Served

Plus, a Chicago-based freight broker boasts about making $215k in one day, Lineage Logistics hits it big with an $18 billion IPO, the latest on the Ocean's 11-style freight heist, and more.

Panama Canal faces its direst drought, impacting global shipping. As slots drop and delays rise, West Coast ports poised to reclaim dominance.

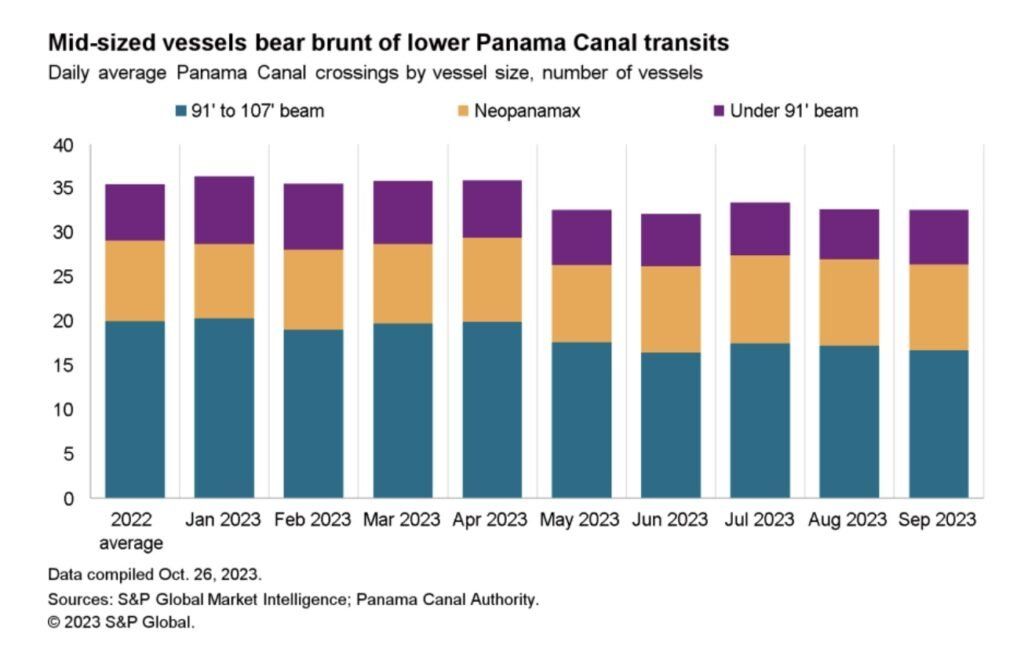

The Panama Canal, a cornerstone of global shipping, faces a severe drought, its worst in over 70 years. Its guardian, the Panama Canal Authority (ACP), reports October as the driest since 1950. Consequentially, to combat plummeting water levels in Gatun Lake, the Canal's primary reservoir, the ACP initiated drastic reductions in ship bookings:

Further insights from FreightWaves reveal a nuanced picture. The Neopanamax locks, which facilitate larger vessels like container ships and gas carriers, are notably affected. For instance, larger container ships travelling from Asia to the U.S. East Coast now experience draft challenges, which equate to cargo losses of 2,100 TEUs. With these constraints, liners are forced to offload cargo on one side of the Canal, transport it via rail, and reload on the opposite side. Plus, LNG carriers and VLGCs, too sizable for the Panamax locks, will likely be rerouted through longer routes, like the Suez Canal or the Cape of Good Hope.

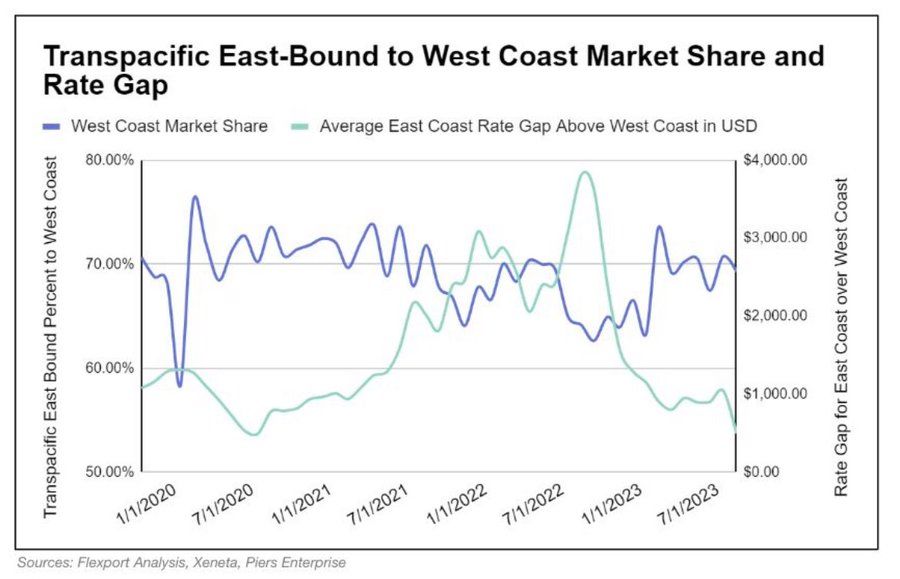

Experts Timothy Dooner and Craig Fuller highlight the Canal's issues as a potential catalyst for a shift in port market share. As the Canal faces bottlenecks, the West Coast ports may see a resurgence, clawing back market share lost to the East Coast since the pandemic.

For logistics professionals, the Canal's constraints underscore the need for flexible shipping strategies and route diversification.

Sources: BBC | FreightWaves

Panama Canal cuts ship crossings further:

— The Conveyor (@ConveyorDaily) November 1, 2023

- Feb 2023: 36 ships per day

- Aug 2023: 32 ships per day

- Nov 2023: 25 ships per day

- Jan 2024: 25 ships per day (est.)

- Feb 2024: 18 ships per day (est.)

More than 3% of global trade passes through the canal. pic.twitter.com/xWreLfBxa4

Join over 10K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe now & be sure to check your inbox to confirm (and your spam folder just in case).