🎣 MC Swaps. Zip-Tied Plates. 15 Thefts And Counting.

Plus: Uber Freight’s $9M hit in Del Monte’s bankruptcy, ATRI says trucking costs are up (again), July 4 cargo theft risks spike, and more.

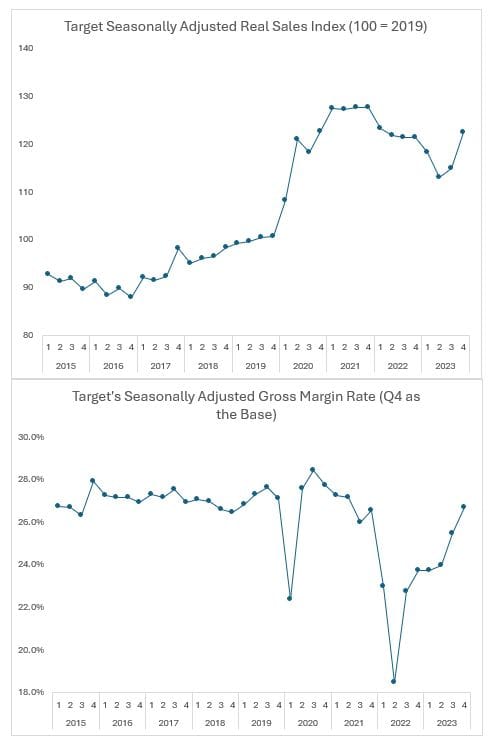

Target's stock reaches a new high with impressive holiday quarter sales and a return to robust gross margins, signaling a strong consumer market.

Target’s recent earnings report has everyone talking—and for good reason. Sales have shot up, hitting the highest point since early 2022. Supply chain expert Jason Miller gives an in-depth analysis on LinkedIn.

What's Behind the Numbers?

Margin Magic

Target's gross margin rate bounced back big time. Basically, for every $100 Target earned, they kept more than at any time since 2021.

Inventory Insight

While not shown in the charts, the time it takes Target to sell its stock is back to the pre-pandemic days of 2018/2019. Fewer goods sit around, meaning the retailer "has resolved its inventory glut."

he Big Picture

"While there are some encouraging signs in the economy, there are also stubborn pressures impacting families and retailers...And yet their affinity for style and newness, plus early signs of disinflation, contributed to a sequential uptick in discretionary-category performance over the last two quarters, something we aim to build on and accelerate." - Target's Chief Growth Officer, Christina Hennington

Why Should We Care?

Once again, Target goes beyond hitting the target and setting new records. Their end-of-year report card shows they've got the formula down: sell more, keep more, and manage stock better. It's a good sign not only for them but for the broader economy.

Source: Jason Miller/LinkedIn

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).