🎣 Honey, Hold My Beer

Here are the Top 500 fleets of 2026. Plus: Sierra snow shuts down I-80, rail targets truckload freight, and ocean rates fall.

Plus, Flock Freight trims down operations, former trucking CEO gets a $5.5M goodbye, and Alaskan truckers are cashing in.

Good Monday Morning. Today is "Act Happy" Day. So suck up the bad rates and just act happy today.

🤔 Question of the Day: According to Bloomberg, cargo theft in Mexico has led to a __% increase in grocery prices. Scroll down to the Around the Freight Web section to find out.

In today's email:

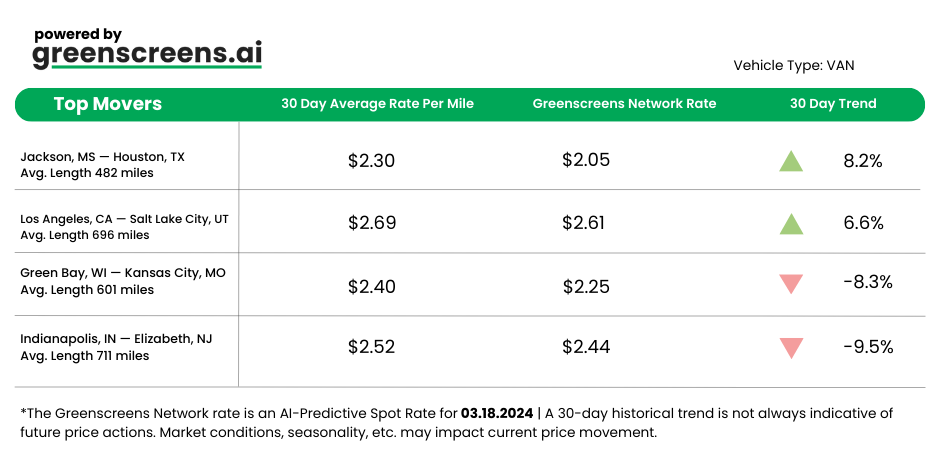

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

*Greenscreens.ai, forecasts real-time truckload buy prices that are suited to each freight brokerage's purchasing power using AI and machine learning. Its engine takes into account over 130 attributes and data points in each rate forecast.

🐔 WHAT’S COOKIN’ IN FREIGHT

✂️ Flock Freight Trims Down Operations. Flock Freight is cutting back to stay ahead as the freight market tightens further. The company announced a workforce reduction of 54 jobs and intentions to double down on tech to refine its truck-sharing niche. Flock's last round of layoffs was reported in April 2023, when 45 jobs were cut. Flock's latest reduction reflects strategic necessity during a prolonged market low, and they aren't the only ones. We've also received information that an Iowa-based trucking and logistics company has closed a few of its offices. We are reaching out to them and will keep you updated.

🤝 $5.5M Exit for Knight-Swift Ex-CEO. David Jackson, the former CEO of Knight-Swift, has sealed his exit with a $5.5 million severance. The deal? A lump sum of $1.85 million, plus installments and a slice of his would-be 2024 bonus. On Feb 26, news broke of Jackson stepping down as CEO and board member. The departure was drama-free, according to the company. Anyway, Jackson's lips have been sealed thanks to non-compete and confidentiality covenants.

💰 Cold Cash. Alaska's Trucking Rush. Alaska's trucking industry is booming, contrasting with freight woes in the Lower 48. This difference may have always been the case, but 2024 and beyond is widening the gap. With oil and mining projects on the rise, the demand for drivers has never been bigger, offering salaries up to $180,000. While the US grapples with a freight recession, Alaska predicts record truckloads, thanks to oil production projects like Willow and Pikka. But, as rigs roll in, lawmakers are considering permits and more regulations to mitigate the ecological impact of more trucks and the oil projects that fuel them. Local communities bring up concerns about the conservation of Arctic land and wildlife.

TOGETHER WITH TURVO

Invite your shippers, carriers, and partners on to your Turvo Network to share, communicate, and solve supply chain issues in real time. Turvo’s unique collaboration technology unifies people, processes, and data, bringing together everyone involved in a shipment for 100% visibility, better on-time deliveries, and a superior customer experience.

Join all size companies using Turvo’s TMS Platform, Mobile App, and the most popular Driver App in the industry. Ask For A Turvo Demo Here.

A LinkedIn post from trucking company Owner Saurabh Bhatti of Soorma Trucking broke down the weekly costs of operating a truck these days.

Bhatti laid out an overview of his weekly expenses.

Danis Sardar, Owner of PDS INC, chimed in to say there are many other expenses that Saruabh didn't account for. Which goes to show that owning a trucking company is not easy so unless you want sleepless nights and tons of stress, avoid it at all costs (pun intended😉).

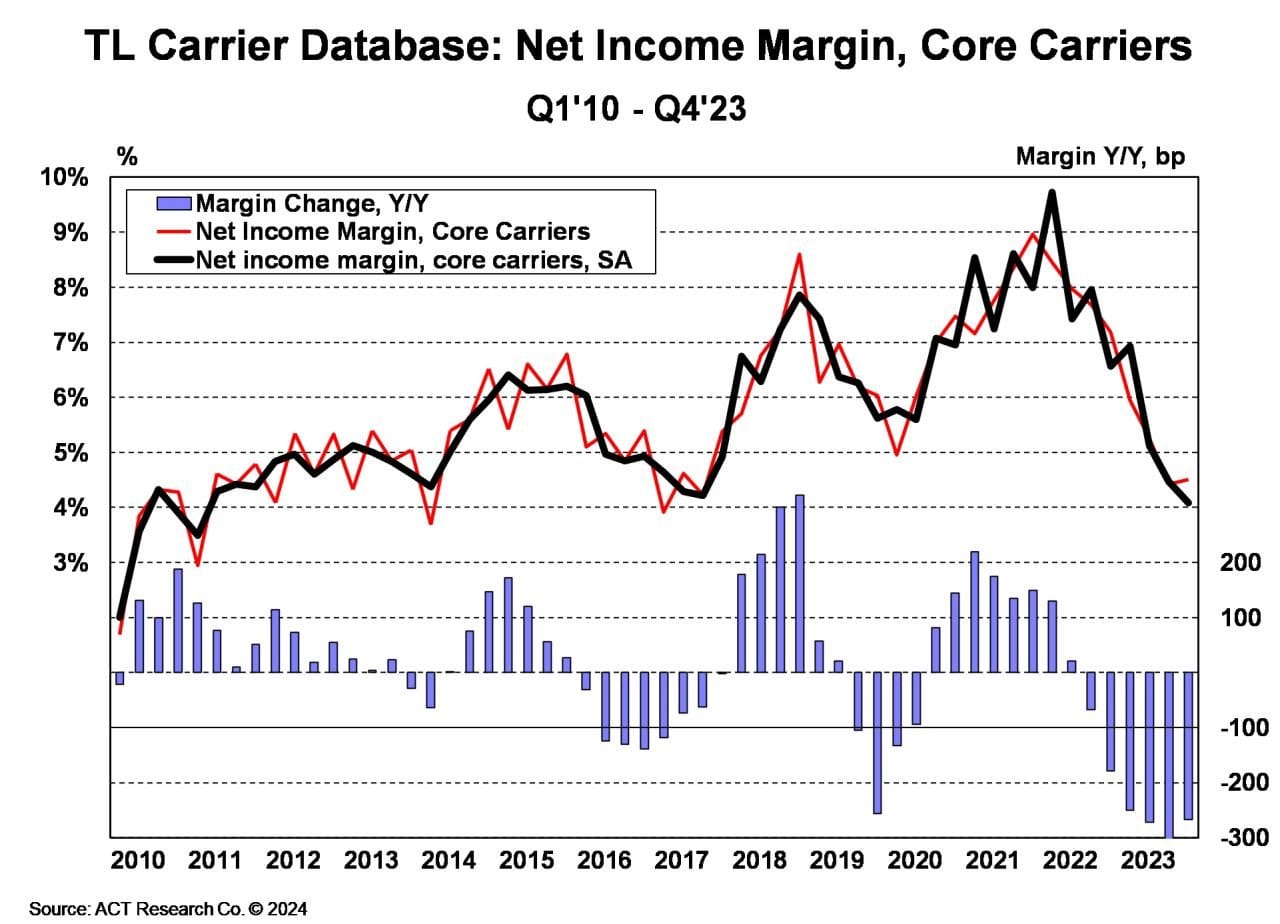

Along with rising expenses for trucking companies, the net income margin has decreased from almost 10% in 2021/2022 to 4%.

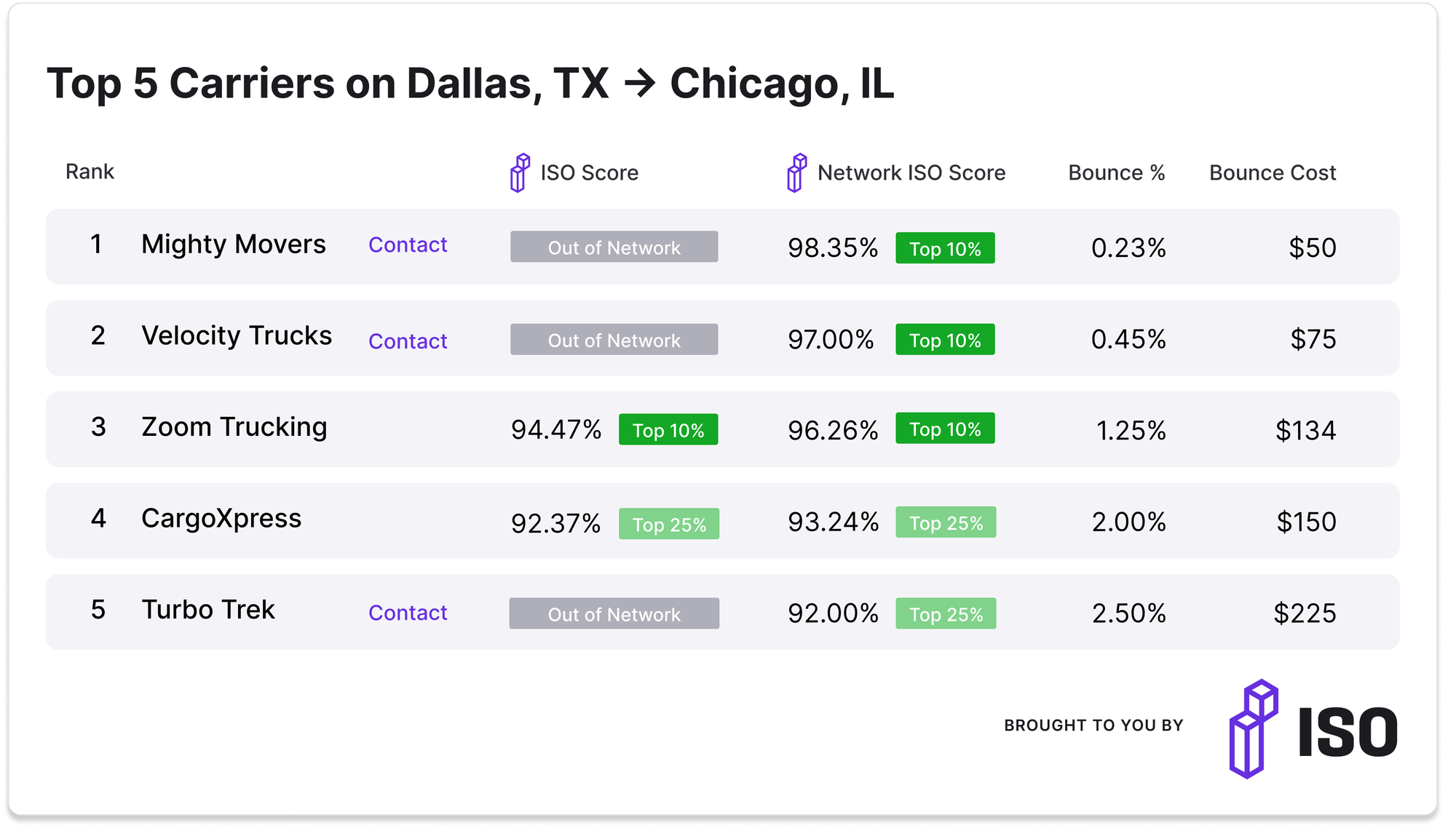

TOGETHER WITH ISO

Carrier reliability is central to everything you do. Are you measuring it?

Booking unreliable carriers leads to higher operational costs: more bounces, more reschedules and more headaches. With ISO, you can source carriers for every lane based on service data. More reliable carriers mean happier customers, higher volumes and lower cost per load. Learn more at iso.io.

AROUND THE FREIGHT WEB

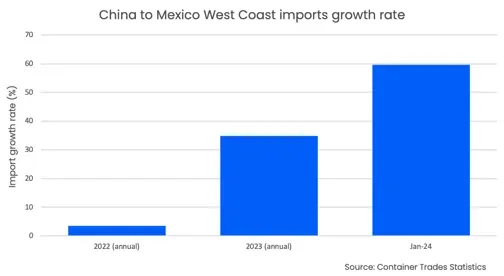

📈 China – Mexico Trade is Booming. Trade between the two nations has grown exponentially these past two years.

🚂 Rail Traffic Increase. The AAR reports a 5% increase in U.S. rail traffic for Week 10 of 2024, with a notable rise in intermodal units overshadowing a decline in carloads, signaling mixed signals for the freight industry.

🇲🇽 Cargo Theft Led to Higher Grocery Prices. Cargo theft in Mexico has led to a 7.6% increase in grocery prices.

👨🏭 Manufacturing Momentum. U.S. manufacturing and consumer goods sectors are boosting truck shipments, as indicated by a 7.3% rise in the Cass Freight Index for February, and the S&P Global US Manufacturing PMI landing above 50 for the first time in 11 months in January.

🚛 Driverless Trucks in Action. Aurora's driverless trucks impress in Pittsburgh demos, showcasing its seamless navigation of roadway hazards.

FREIGHT MEME OF THE DAY

Also, check out:

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).