🎣 The War Begins

Plus: Algorhythm Holdings Up 3.6x, Flexport Targets IPO, Roadcheck 2026 and more.

Today's feature explores the unexpected shutdown of Convoy, shedding light on its impact and ripple effects across the freight industry from its founding to the present.

Happy Friday. We mistakenly sent an email earlier that was intended to be a blog post, so we apologize for sending two emails this morning. Today's feature explores the unexpected shutdown of Convoy, shedding light on its impact and ripple effects across the freight industry from its founding to the present. Additionally, we cover Transfix's $40M Series F funding amidst market challenges and provide insights from Reliance Partners into the evolving logistics landscape, plus more.

In today's email:

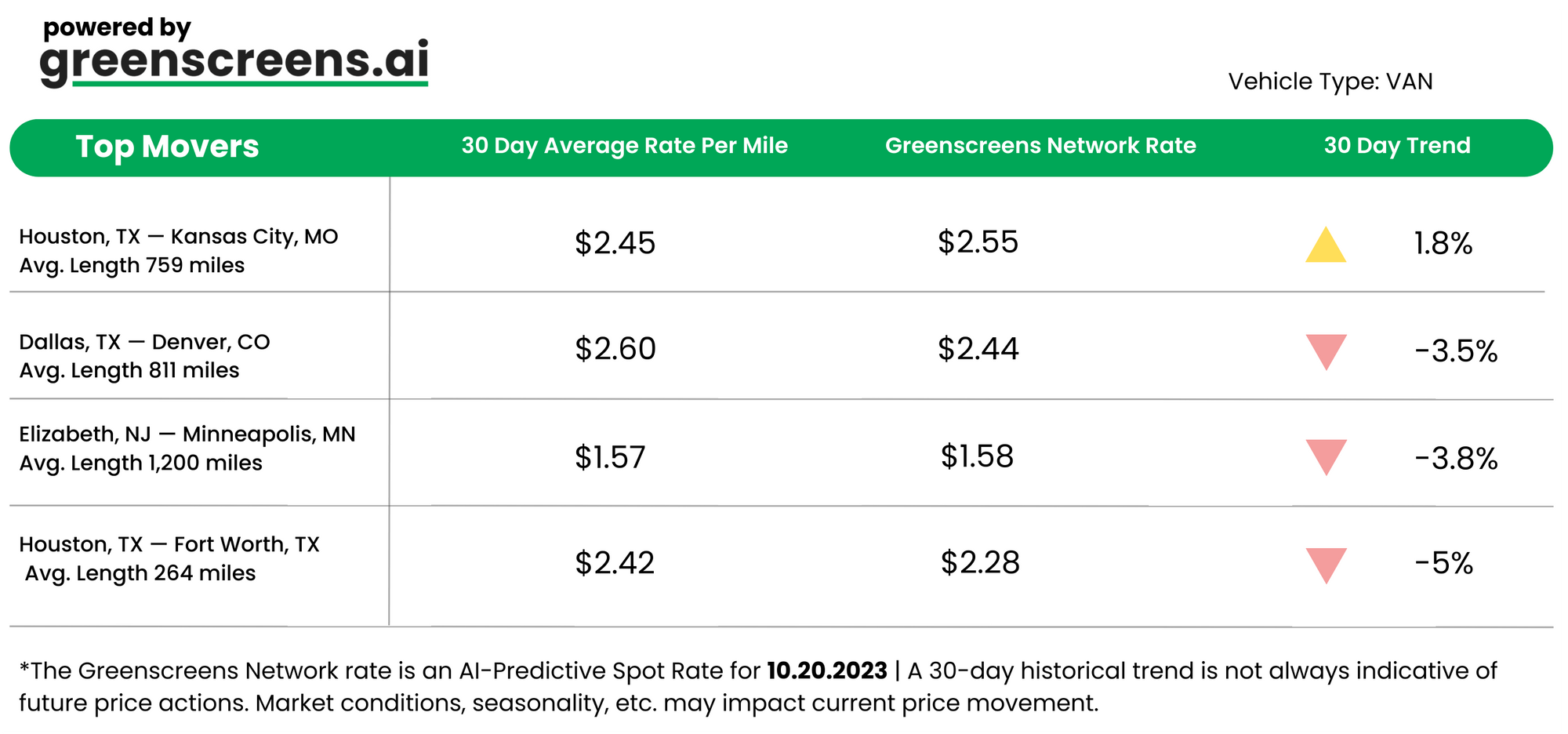

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

*Greenscreens.ai forecasts real-time truckload buy prices that are suited to each freight brokerage's purchasing power using AI and machine learning. Its engine takes into account over 130 attributes and data points in each rate forecast.

🐔 WHAT’S COOKIN’ IN FREIGHT

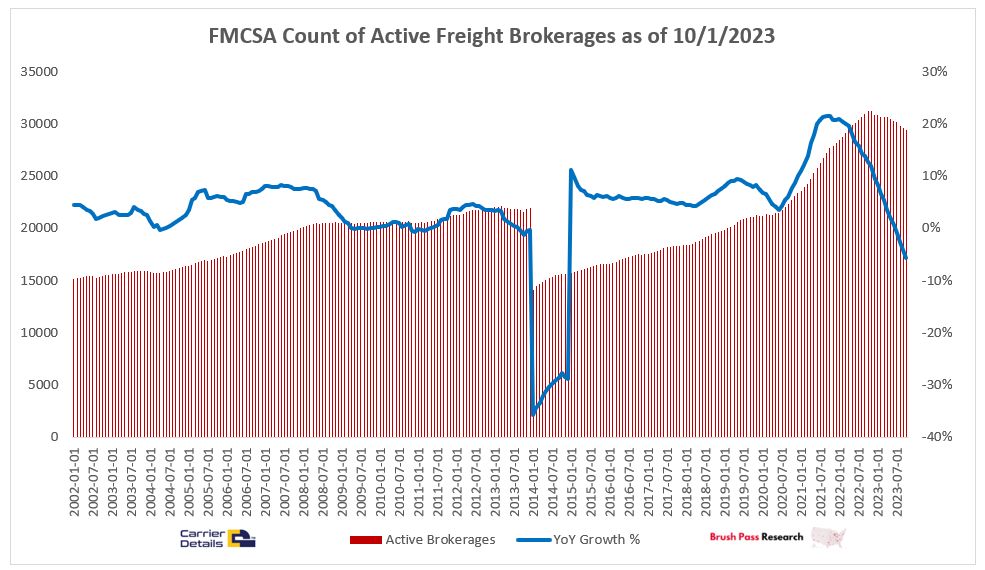

📉 Freight Brokerages See Biggest Drop Since 2014. The number of operating freight brokerages has experienced its most significant decrease since a notable dip in 2014, with growth rates turning negative from July 2023. By October 2023, the count of active and authorized brokerages decreased by 5.6% compared to the same month in the previous year. This decline follows a period of rapid expansion during the pandemic. This information was shared by Kevin Hill from Brush Pass Research.

💰 Transfix Raises $40M Amid Freight Market Turbulence. Transfix, a digital freight platform similar to Convoy, has successfully secured $40 million in Series F funding. However, this triumph is overshadowed by a stark 60% devaluation from its March 2020 valuation, reflecting the challenges in the venture capital and freight markets. Social media is rife with skepticism.

🚚 Reliance Partners' Insights. Amidst Convoy's surprise departure, Reliance Partners' Chad Eichelberger offers insights, highlighting the industry's need for a unified voice against stringent shipper demands and emphasizing the importance of firm contracts, carrier vetting, and understanding insurance. With peak motor carrier cancellations observed in May, there's a noted 20% dip in freight brokerage revenue.

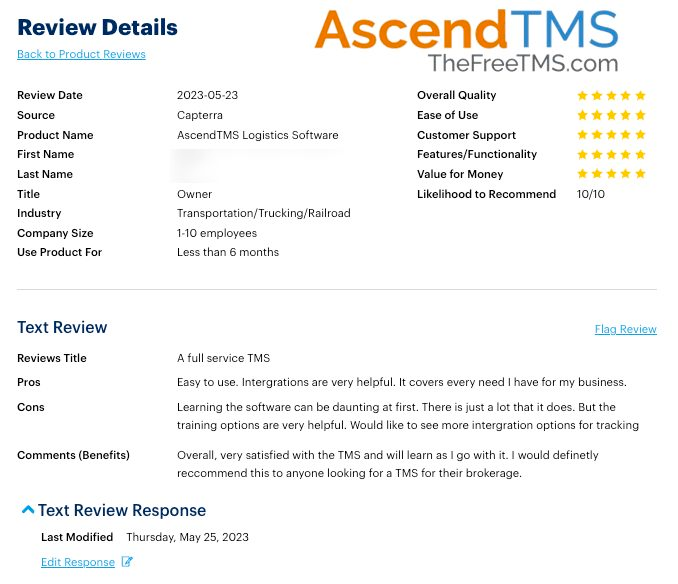

THE WORLD'S MOST POPULAR TMS

AscendTMS is the world's most popular & best-rated TMS. Use our referral code RA-FreightCaviar! to receive 3 months of AscendTMS Premium for free. It only takes 20 seconds to sign up and no credit card is required. Click here to learn more.

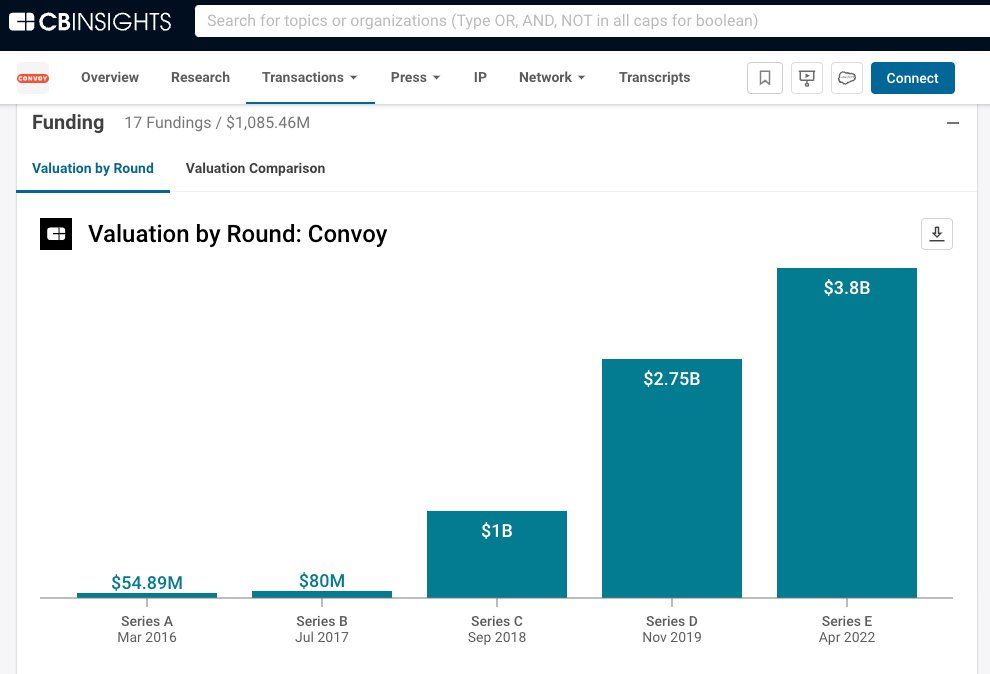

Convoy, with a valuation of $3.8 billion and led by ex-Amazon and Microsoft executive Dan Lewis, has stunned the freight world with its unexpected shutdown. Lewis cited a devastating "freight recession" and intense "monetary tightening" as significant hurdles. Describing the situation as the "perfect storm," he recognized Convoy's revolutionary efforts in an emotional memo, asserting its indelible mark on the industry despite present circumstances.

Dan Lewis and Grant Goodale's experience at Amazon inspired Convoy's founding in 2015. Initially catering to the Puget Sound region of Washington, their ambition blossomed into an industry-changing mission to offer endless capacity with zero waste. By creating an Uber-esque platform for truckers and shippers, Convoy was determined to overhaul traditional brokerage with tech-centric solutions.

Starting as a local entity in 2015, Convoy experienced exponential growth:

Despite its innovation-driven ascent, Convoy faced significant challenges. The company underwent multiple rounds of layoffs, the latest in 2023, mainly impacting the customer service segment. The move was a response to increasing efficiency demands and a freight market downturn.

The recent amicable settlement of a dispute with OTR Solutions, placing Convoy on a "Do Not Buy" list, hinted at financial troubles. The freight industry's evolving dynamics, with shippers preferring private fleets, adversely impacted the brokerage sector.

Convoy's closure became official when sale negotiations fell through. Lewis revealed that despite extensive efforts to find potential buyers, none met Convoy's expectations for continuing its legacy. However, there's a glimmer of hope as significant logistics entities, such as Maersk and UPS, show interest in Convoy's cutting-edge tech stack. A dedicated team will manage Convoy's winding down and potential future strategies.

Matt Silver, reflecting on Convoy's journey, pointed out the transformative role the company played in blending freight and tech. Despite the criticisms of their business model, Convoy's innovative approach forced traditional freight brokerages to upgrade their tech game. The company's driver app revolutionized driver-brokerage interaction, offering a glimpse into the future of digital freight operations. Furthermore, Convoy attracted tech talent, infusing fresh perspectives into an age-old industry.

Despite the immense backing and visionary approach, profitability eluded Convoy. Senior Logistics Executive, Dean Sinadinoski, opined that the company's aggressive tech development, funded by outside investors, led to overspending on employee compensations. With no profit in sight and substantial losses on each transaction, Convoy faced the inevitable – a downfall, leaving the investors and shareholders bearing the brunt.

TOGETHER WITH ISOMETRIC TECHNOLOGIES (ISO)

What if you had access to this type of data the next time you cold call a Shipper? ISO is the industry’s first neutral Service Index, providing freight brokers with a platform to objectively measure their performance strengths. Gain access to industry-wide performance benchmarks, dynamic carrier & customer scorecards, and powerful analytics to raise service standards across your network. Visit iso.io to get started.

AROUND THE FREIGHT WEB

👏 Forklift Certified CEO. The new CEO at Costco started as a forklift driver. Talk about climbing the corporate ladder over four decades.

🚛 U.S. Xpress Turnaround. Knight-Swift Transportation is acing the USX turnaround game. The company's 45% spot exposure plummeted, and they're setting their sights on a 2024 profit.

🚢 Record-breaking September at Long Beach. Thanks to holiday shopping and new labor agreements, the Port of Long Beach hits its busiest September, with cargo volumes spiking.

🚪Closed Doors for CFL. After a 95-year journey, the family-owned trucking and brokerage company, Certified Freight Logistics is shutting down.

🛍️ Retail Rises & Surprises. September retail sales beat the odds, soaring to a 0.7% monthly growth, dwarfing the Dow Jones estimate.

FREIGHT CONFERENCES WE'RE ATTENDING

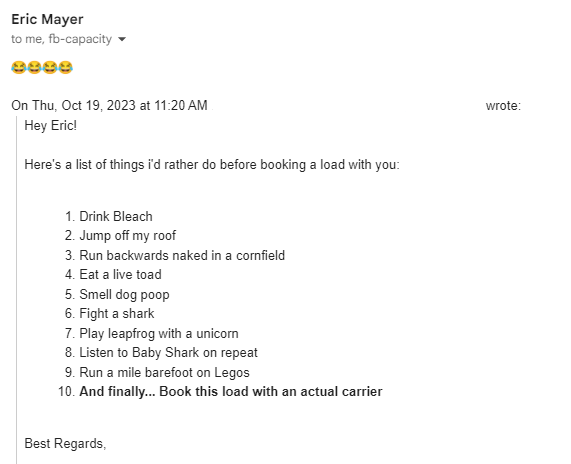

FREIGHT MEME OF THE DAY

Also, check out:

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).