🎣 “Chameleon Carrier”

Why chameleon carriers are suddenly everywhere. Plus a freight tech Super Bowl moment, Uber Freight breakeven, and more.

Intermodal rail makes a comeback in the U.S. market, and efficiency dynamics transform at Laredo Bridge.

As the logistics industry recalibrates, recent trends point to a significant shift from trucking to intermodal rail. Domestic intermodal loaded container volumes have soared to their highest since 2021, potentially signaling concerns for the already beleaguered truckload market.

Here's a snapshot:

However, the pandemic's wake left the railroads grappling with congestion issues, especially around ports and rail ramps. Even though truckload rates had spiraled in 2020 and 2021, by early 2022, the rapid decrease in these rates led to diminishing discounts for shipping via rail.

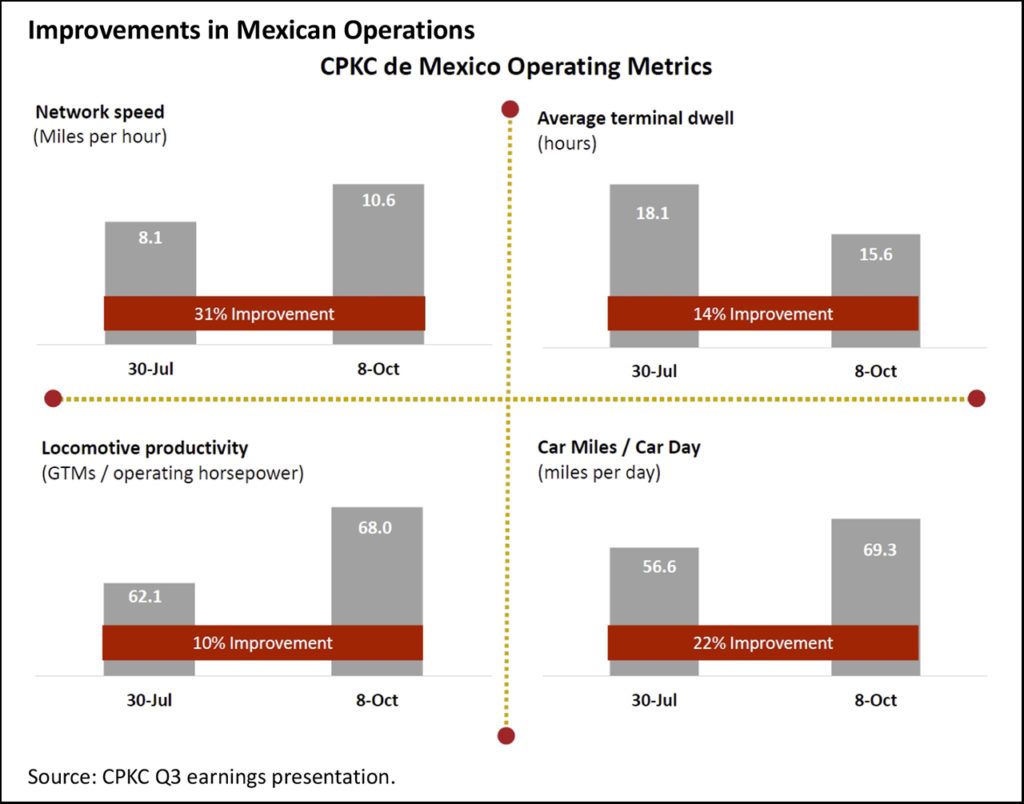

Rail Improvements in Mexican Operations

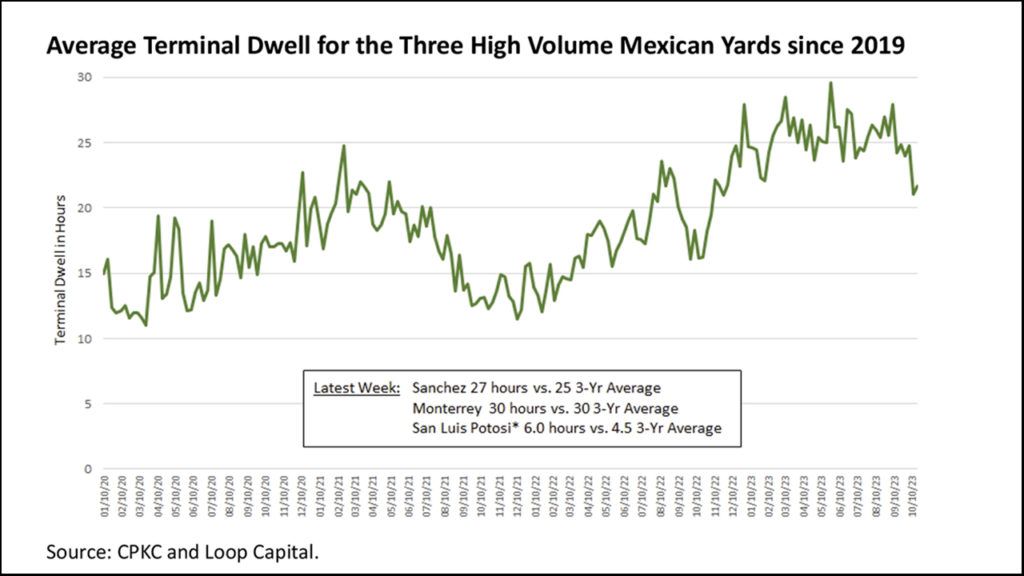

On another front, efficiency improvements in CPKC’s operations in Mexico signal a positive turn after an inactive year. Key metrics such as terminal dwell times have seen remarkable improvements, especially in areas like Sanchez Yard.

Moreover, the industry's most significant international gateway, Laredo, underpins the railroad's advantage over trucks, as the former boasts faster transit times.

As rail continues to grow, the impacts on the trucking market could increase the speed of capacity exits, bringing quicker stabilization.

Sources: FreightWaves | Railway Age

Domestic rail container volumes hit an all-time high!

— Luke Falasca (@LukeFalasca) October 26, 2023

This is driven by increased demand for intermodal, but also a significant increase in empty containers being brought to market as companies like $JBHT and $KNX expand their container fleets! pic.twitter.com/JInMNjVzTs

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).