🎣 From Speed Limiters to Stolen Loads: The Week in Freight

Happy 4th of July Week: Here's a round-up of the most engaging and talked-about freight content from around the web and from us.

Three LTL companies are set to benefit the most from Yellow Corp's bankruptcy.

Yellow, who had a 10% share of the LTL market, halted operations on Sunday and is expected to file for Chapter 7 bankruptcy today. This anticipated move is poised to cause a significant shift in the market share of the industry. Among the companies expected to reap the benefits are non-union carriers XPO Logistics, SAIA, and Old Dominion Freight Line, owing to their flexible cost structures and recent gains in market share.

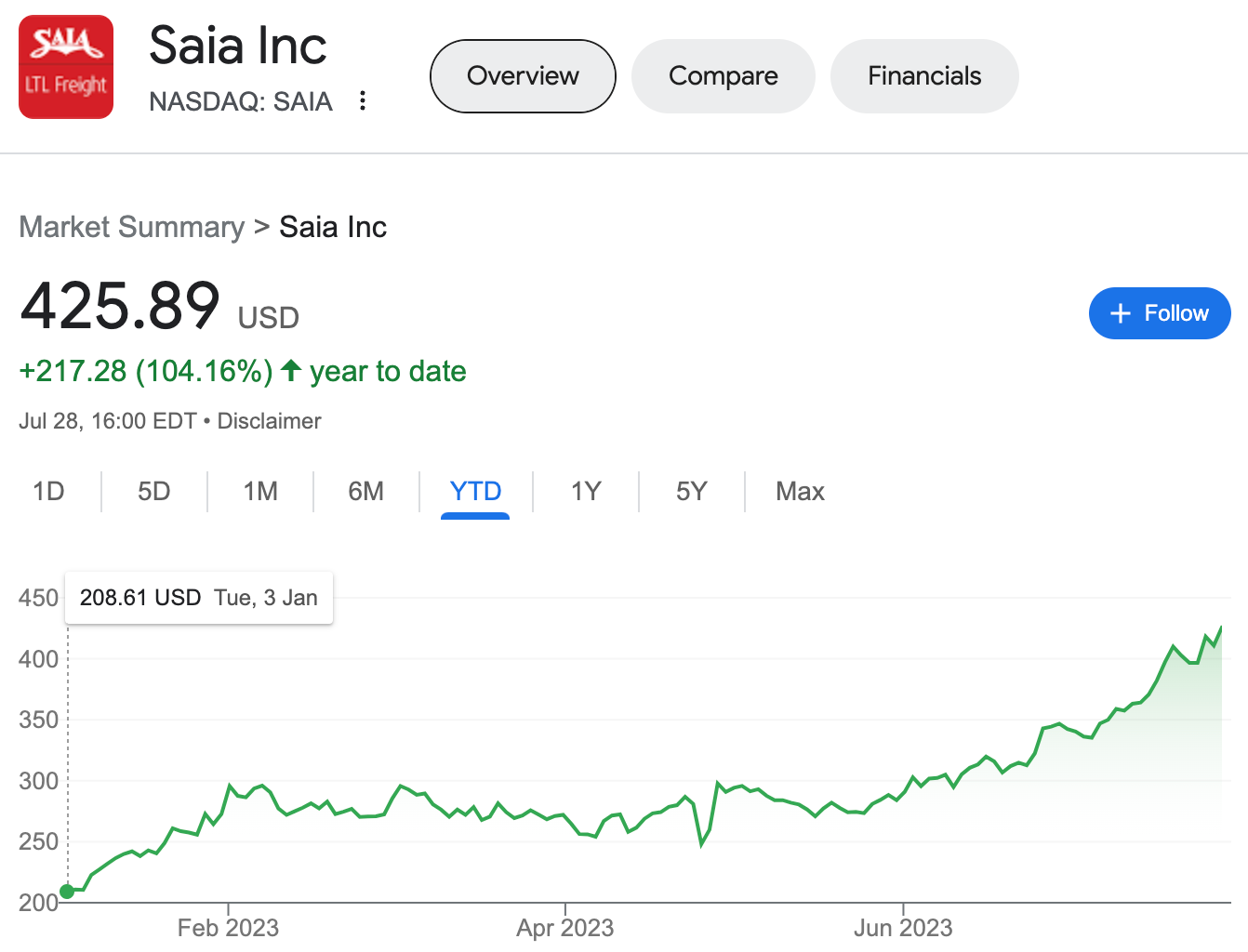

Already in late June, analysts from the Bank of America had projected a potential bankruptcy for Yellow and identified the companies most likely to profit from such a development. Their top picks were XPO, SAIA, and Old Dominion Freight Line. These predictions seem to be aligning with the reality as the Year-to-Date (YTD) share prices of these companies have shown exceptional performance since the release of the report.

The stock price of XPO has seen a surge of 21% (an impressive 121% YTD) while SAIA has grown by 24% (104% YTD). Similarly, Old Dominion's shares have risen by 15%, marking a 54% increase YTD. This exceptional growth could be the first indicator of the positive market effects these companies are likely to experience as a result of Yellow's bankruptcy.

.@Yellow_Trucking is(was) 10% of the LTL market. 3rd largest LTL carrier in the country.

— Justin Martin (@supertrucker) July 27, 2023

Source: Nasdaq.com

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).