🎣 Warrants Served

Plus, a Chicago-based freight broker boasts about making $215k in one day, Lineage Logistics hits it big with an $18 billion IPO, the latest on the Ocean's 11-style freight heist, and more.

US ports face new challenges with a surge in West Coast imports and East Coast disruptions due to Red Sea attacks.

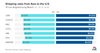

US ports on the West and East Coasts are facing a period of adjustment and challenge. With the West Coast experiencing a surge in imports and the East Coast dealing with potential disruptions from Red Sea attacks, the entire US port system is adapting to a fluid and complex global trade environment.

US West Coast ports are gearing up for a significant increase in imports, thanks to various factors:

On the other side, East Coast ports face potential disruptions due to labor contract negotiations. Simultaneously, ocean freight rates are undergoing notable changes:

Both coasts are witnessing a balancing act in response to global and domestic pressures:

Sources: The Loadstar | CNBC | GCaptain

Join over 10K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe now & be sure to check your inbox to confirm (and your spam folder just in case).