🎣 Warrants Served

Plus, a Chicago-based freight broker boasts about making $215k in one day, Lineage Logistics hits it big with an $18 billion IPO, the latest on the Ocean's 11-style freight heist, and more.

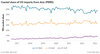

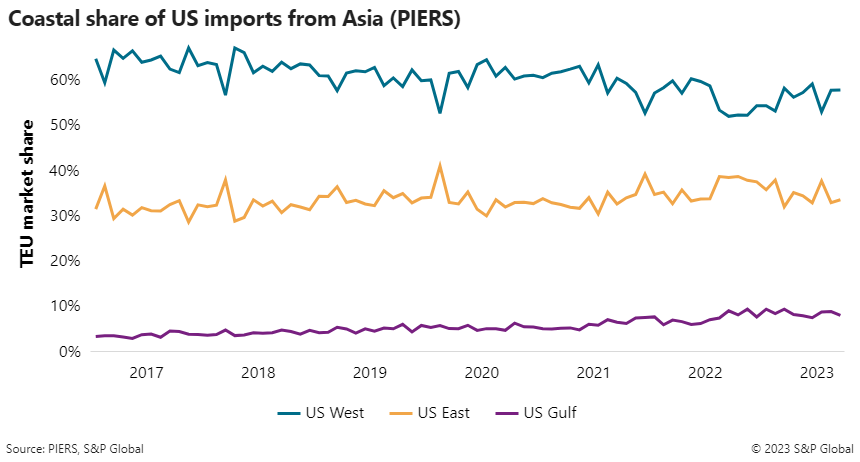

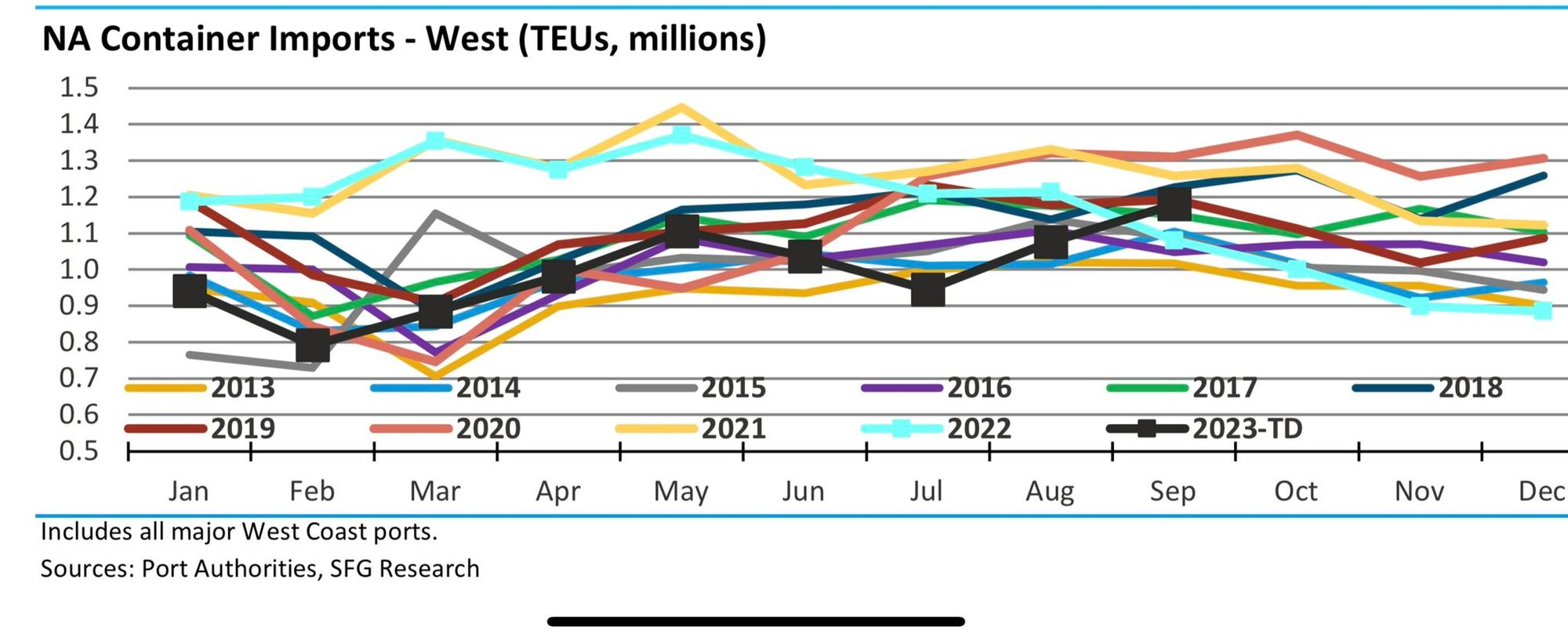

Analyzing the shift of US imports from Asia: West Coast ports show resurgence as East Coast metrics present a mixed bag.

US imports from Asia are seeing a noticeable shift. The West Coast, especially, is making waves as it starts to reclaim its dominant position for imports.

Highlights:

This return of cargo to the West Coast might be influenced by the recent ratification of the International Longshore and Warehouse Union contract. This move has significantly boosted retailers' confidence, evidenced by the ports' ability to handle more cargo almost immediately.

It's crucial to monitor the port dynamics, especially considering the September 2024 expiration of the labor contract for East and Gulf Coast ports.

Sources: Journal of Commerces' Gateway | John Paul Hampstead/Twitter

Panama Canal issues are having an impact.

— HUNTSMAN 🏴☠️ (@maphumanintent) October 24, 2023

I'd also guess that efficiency is down for USEC rail carriers vice USWC on IPI, but that's a hunch based on personal experience.

Join over 10K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe now & be sure to check your inbox to confirm (and your spam folder just in case).