🎣 Freight Stocks Got Rocked

A penny stock wiped $4.8B off C.H. Robinson's market cap yesterday. Plus: self-driving trucks are now running 1,000 miles nonstop, STG Logistics cleared a major bankruptcy hurdle, the FMCSA revoked nine ELDs, and more.

Which American manufacturing sectors are most vulnerable to China's economic slowdown? Two charts, key industries, and their implications in this analysis from Jason Miller.

One pressing question looms in a world where economies are hyper-interconnected: How does China's economic slowdown impact U.S. manufacturing? Supply chain professor Jason Miller breaks it down.

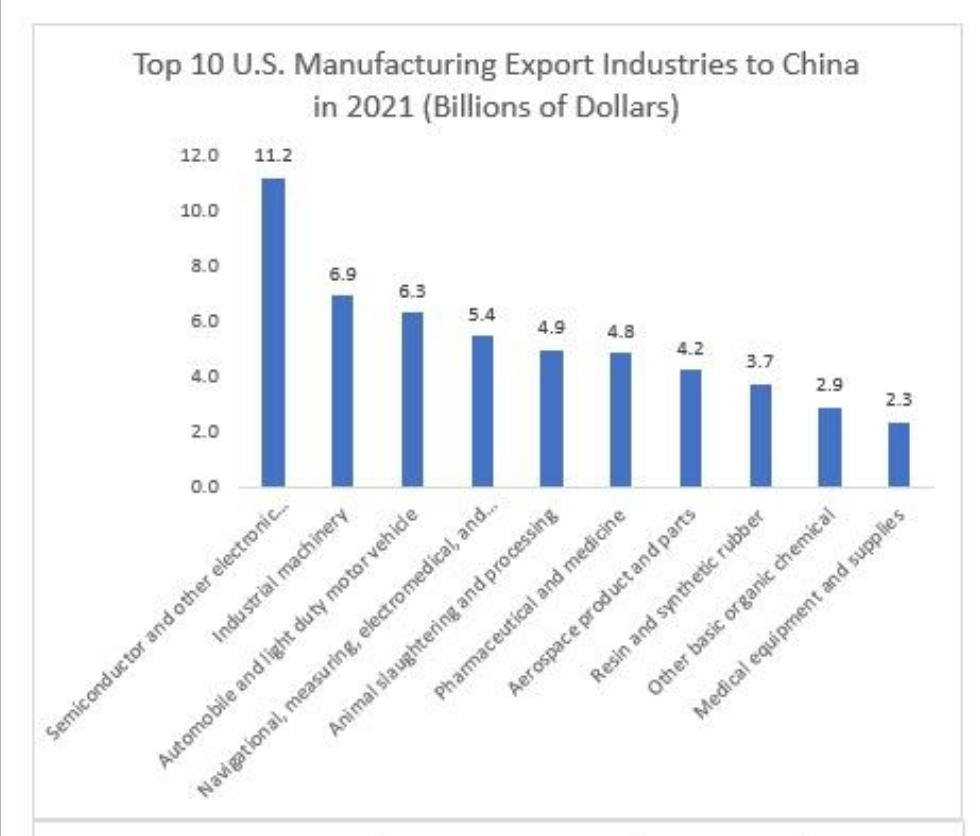

Chart 1: Top 10 Export Industries to China (2021)

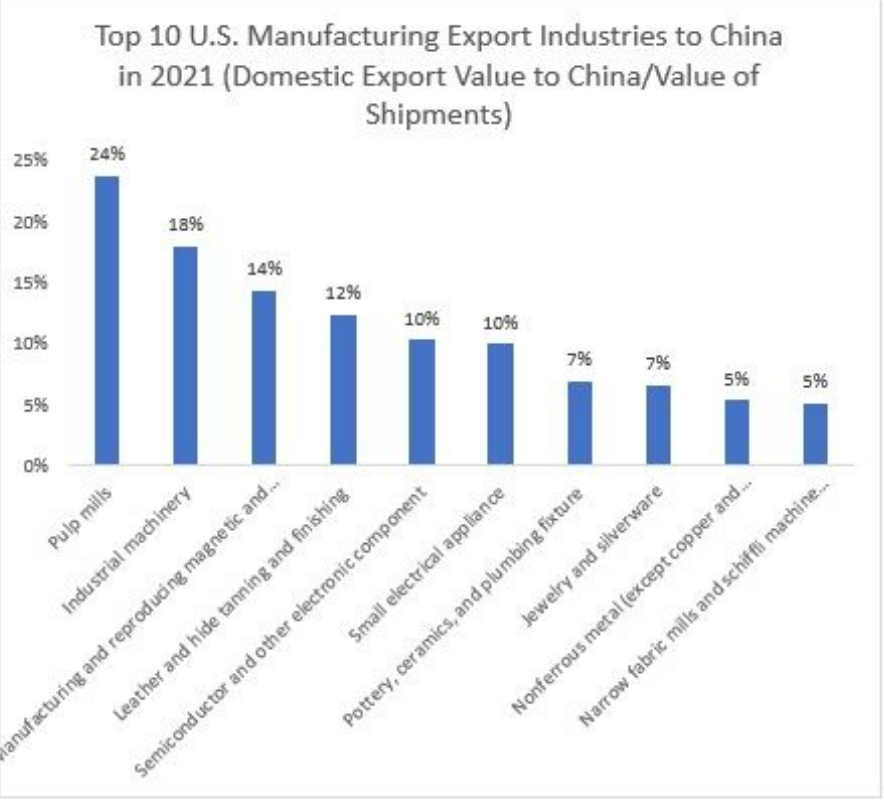

Chart 2: Most Exposed Industries to China Slowdown

Crunching the Numbers

Major Industries Affected

So pulp mills and industrial machinery face major challenges. Additionally, the chemical manufacturing sector feels the heat. Still, most U.S. manufacturers are largely unaffected by China's economic issues.

#MintPlainFacts | It is often said that when China sneezes, the world catches a cold. But the reality is that some countries are more at risk from a slowdown in China.

— Mint (@livemint) September 20, 2023

Read here: https://t.co/ituHqYzl98 pic.twitter.com/eudSxazsgk

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).