🎣 Warrants Served

Plus, a Chicago-based freight broker boasts about making $215k in one day, Lineage Logistics hits it big with an $18 billion IPO, the latest on the Ocean's 11-style freight heist, and more.

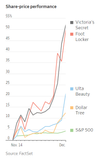

Retailers see stocks surge, with Victoria's Secret and Foot Locker leading the rally. S&P 500 gains indicate broader market optimism.

This holiday season, retailers like Victoria's Secret and Foot Locker are experiencing a stock market rally, despite modest forecasts and mixed updates.

Since a November 14 CPI report revealed a softer-than-expected inflation rate, investors have rallied around retail stocks, leading to significant surges. The optimistic sentiment, spurred by expectations that the Federal Reserve may halt interest rate hikes, has resulted in a sharp decline in Treasury yields and a boost for equities. Warehousing adjustments and inventory management also play key roles in shaping investor outlook.

Victoria's Secret - 52% Increase

Foot Locker - 50% Increase

Ulta Beauty - 21% Increase

Dollar Tree - 12% Increase

S&P 500 - 4.1% Increase

Source: The Wall Street Journal

Join over 10K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe now & be sure to check your inbox to confirm (and your spam folder just in case).