🎣 C.H. Robinson

Here is another round-up of the most engaging and talked-about freight content from around the web and from us.

Freight brokers face Q4 turbulence with tariffs, the end of de minimis, an 80% USPS traffic collapse, and a proposed $85B rail merger.

The U.S. freight market is confronting two major developments at once. On one side, the wave of tariffs and the accelerated repeal of the de minimis rule are reshaping import flows and customs processes just as the holiday season approaches. On the other hand, Union Pacific and Norfolk Southern’s $85 billion merger will create the nation’s first transcontinental railroad.

For freight brokers, the overlap of these developments brings heightened volatility, but also new opportunities in customs services, intermodal brokerage, and client advisory work.

The first shoe dropped on August 1, when the White House imposed a 50% duty on semi-finished copper products and reinstated reciprocal tariffs on imports from Brazil, Canada, China, and the European Union.

Then on August 19, the U.S. Commerce Department widened its scope. Reuters reported that the administration “announced new 50% tariffs on more than 400 additional metal and heavy equipment categories, including railcars, cranes, bulldozers, wind turbines, and electric vehicle parts.” These duties directly touch freight lanes tied to construction, energy, and automotive supply chains.

The most disruptive change, however, is the accelerated end of the de minimis exemption. Originally slated to expire in 2027, the program allowing sub-$800 imports to bypass duties and formal customs entry will end on August 29, 2025. The repeal triggered immediate fallout: according to the Universal Postal Union, international postal traffic to the U.S. fell more than 80% overnight, with many foreign postal operators suspending service until they adapt to the new requirements.

As SupplyChainDive reported, “The fast-approaching end of the de minimis exemption could pose challenges for e-commerce supply chains’ peak season plans.” Maggie Barnett, CEO of LVK Logistics, said importers are scrambling: “They just thought [the elimination] wouldn’t happen so fast.”

The shortened timeline means many direct-to-consumer importers have little time to adjust before Q4. Anthony Pizza of Accelerated Global Solutions told SupplyChainDive: “The major retailers and all of our clients will be ready for peak, but headaches and hiccups will emerge for unprepared businesses.”

For U.S. domestic freight brokers, the direct impact of the postal traffic collapse is limited because most of that volume consisted of small international parcels moving through USPS rather than truckload or LTL networks. But the indirect effects matter:

This shift creates opportunities for brokers to provide customs filing services, 3PL partnerships, and intermodal solutions that keep goods moving efficiently.

On July 29, Union Pacific announced plans to acquire Norfolk Southern in an $85 billion deal, creating a 52,000-mile transcontinental network across 43 states. The company said the merger will “create America’s first transcontinental railroad” and deliver $2.75 billion in annual synergies by 2027. MODE Global welcomed the deal, saying it sees “major benefits for shippers and the intermodal market overall.”

But critics caution that previous Class I mergers often brought service problems and higher costs. The Washington Monthly warned the deal “could go off the rails,” highlighting risks of reduced competition and integration challenges.

Investor pressure is also mounting elsewhere. Reuters reported that hedge fund Toms Capital has built a stake in CSX, while Ancora Holdings criticized the railroad’s “anemic shareholder returns” and threatened a proxy fight if consolidation is not pursued.

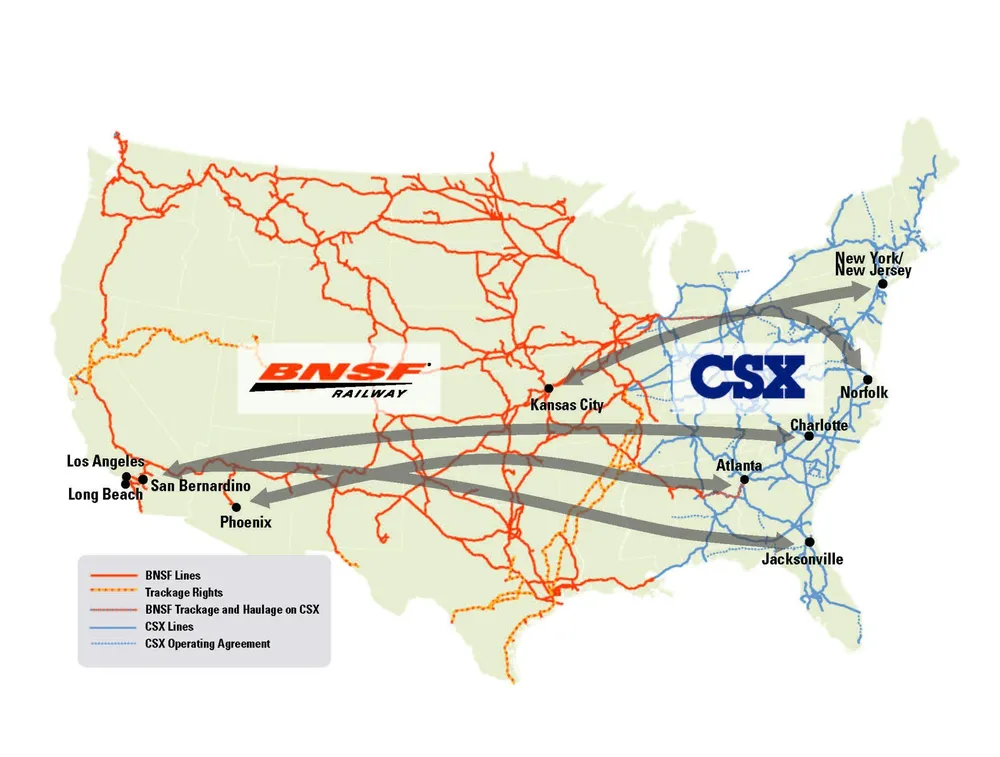

Even as investors press for change, CSX and BNSF have expanded cooperation. The railroads announced new joint intermodal services linking:

The partnership expands CSX’s reach while giving BNSF greater access to eastern markets. Analysts are noting that a potential BNSF–CSX merger could create a coast-to-coast network valued at over $200 billion, intensifying speculation that Union Pacific’s move may spark a wave of consolidation.

The timing matters. Tariff-driven volatility in import flows is colliding with rail industry consolidation. Freight brokers will face:

For brokers positioned in intermodal, the merger could become a growth opportunity. For others, it spells the need to diversify rail relationships and keep truckload alternatives ready.

The shake-ups in tariffs, de minimis, and rail consolidation won’t hit all brokers equally. For those operating mainly in the domestic truckload and LTL markets, the most actionable opportunities come from rail dynamics:

On the tariff side, the big postal traffic collapse, there are second-order effects to watch:

Heading into Q4, freight brokers will be navigating a market where customs paperwork, tariff surcharges, and rail consolidation all converge.

The repeal of de minimis on August 29 will test how quickly e-commerce shippers can pivot before holiday demand. The UP-NS merger, meanwhile, promises efficiency gains but also raises new questions about competition and service reliability.

For brokers, success in this environment will come from adapting contracts, expanding intermodal solutions, and stepping into an advisory role for clients who need more than just capacity.

Source: SupplyChainDive | Manila Times | The Washington Monthly | Reuters 1,2

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).