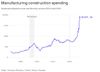

The U.S. is experiencing a significant rise in investment in its heavy industry, marking a possible economic trend shift with long-term implications. Dubbed the "manufacturing supercycle," this development comes after a decade of chronic underinvestment. Now, substantial funding is being directed towards large-scale megaprojects such as batteries, solar cells, and semiconductors.

The boom is being fueled by President Biden's Inflation Reduction Act, Bipartisan Infrastructure Law, and CHIPS and Science Act, alongside pent-up demand. The trend indicates persistent increased demand for workers and raw materials in the coming years. Joseph Quinlan, head of CIO Market Strategy at Merrill and Bank of America Private Bank, sees this supercycle extending into the latter half of the 2020s, largely driven by foreign direct investment.

As of April, spending on manufacturing construction is at a $189 billion annual rate, triple the average rate of the 2010s. This trend contributes to the strength of the U.S. economy, even amid fears of a recession. The supercycle is expected to alter the economic landscape of the U.S. through the 2020s, creating more high-wage jobs and increasing demand for capital.

Source: Axios