🎣 Schneider's Weak Q4

Plus: AGX Freight suspends operations, Gatik goes fully driverless, Werner buys FirstFleet

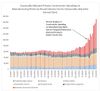

Morgan Stanley predicts Q2 2023 to be the bottom of the cycle for trucking companies, with estimates adjusted ahead of the earnings season.

Comprehensive analysis of the Q2 2023 North American truckload freight rates, including van and reefer rates, along with future predictions based on market trends and predictive models.

As shipping rates fall, many who started trucking companies during the pandemic, like Arnesha Barron, are facing financial hardship. Discover their stories.

Knight-Swift Transportation lowers operating performance forecast due to persistently soft demand in the full truckload market.

The rapid hiring in warehousing during the pandemic slows down, reflecting changes in the labor market and a slowdown in online sales growth.

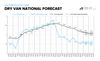

Amidst a surplus of supply and dropping demand, contract rates in the dry van truckload market continue to experience a downward trend.

Convoy adjusts staffing levels in response to market conditions, underscoring the challenges and resilience in the logistics sector.

Knight-Swift boosts assets with the $808m acquisition of U.S. Xpress, poised to reshape the logistics industry landscape and market dynamics.

Amid weak freight rates and the influx of new ships, container lines like Zim are struggling, looking for ways to reduce their legacy charter liabilities.

Spot market faces a stagnant bottom due to lack of consistent trends. While there are some rate upticks, major surge in rates seems unlikely without a significant market shift.

Despite the deflationary inflection point in Q1 2023, Pickett Research forecasts a shift towards inflation in the TL rate cycle by Q4 2023.

Despite the rise in US manufacturing spending, the expected impact on trucking freight volumes may not be as significant due to industry specifics.

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).